Texas gives new business owners a smooth start with easy LLC rules.

You should be aware of the tax system in Texas before setting up your LLC. Texas is a good place to start a business because people don’t owe income tax, and LLCs face few state tax fees. Yet, there are various tax duties you will have to look after.

Most LLCs in Texas must file a franchise tax report annually, with tax liability based on the company’s revenue. Even if an LLC is not obligated to pay taxes, it must still file annual reports to stay active with the authorities. A Texas LLC will have federal taxes, local sales taxes and work-related taxes when you hire workers.

This guide explains all the legal steps to start your LLC in Texas in 2025 and file the right documents to ensure you meet all Texas LLC tax obligations.

Table of Contents

- Why Start an LLC in Texas?

- Understanding LLCS in Texas: Why It’s a Smart Move

- Step‑by‑Step Guide to Forming Your Texas LLC

- Cost Breakdown for a Texas LLC

- Ongoing Obligations for Your Texas LLC

- Why Starting an LLC in Texas Could Be a Game Changer

- Is an LLC in Texas Right for You? Possible Downsides

- What Comes Next After Forming Your Texas LLC

- Frequently Asked Questions (FAQS)

- Conclusion: Ensuring Your LLC is Legally Protected

Why Start an LLC in Texas?

Limited Liability Protection:

When you start an LLC in Texas, your interests are protected from claims against your company. You are generally safe from losing your personal things because of liabilities at your LLC.

No State Income Tax:

People living in Texas do not have to pay income tax to the state. Most LLCs are not required to pay corporate income tax. Yet, depending on your income, there could be a need to pay a franchise tax.Visit the Texas Comptroller’s Franchise Tax page for more details.

Flexible Tax Options:

A one-person LLC is normally taxed as a sole proprietorship, while an LLC with several members is taxed as a partnership. Should you choose, you can file the needed forms with the IRS to apply for S Corp or C Corp tax status.

Easy to Manage:

Managing an LLC in Texas is simple for business owners. Since there are no regular meetings or major reporting duties, this saves small business owners time to manage daily work.

Boosted Business Credibility:

Including an LLC with your company name can improve your professional reputation. It demonstrates to your customers, investors, and partners that your business is registered in Texas and operational.

For comprehensive information and legal resources, visit the Texas Secretary of State – Business Services Division.

Understanding LLCs in Texas: A Smart Business Strategy

Texans can enjoy the benefits of corporations and the simple way of operating a business in a sole proprietorship or partnership with an LLC. Many entrepreneurs in Texas like to incorporate LLCs as they enjoy the convenience of running the business and the assurance of being protected by the law.

Personal Asset Protection:

Establishing an LLC can help prevent any claims or debts made against your business from involving your personal home, car or bank account. This ensures that your business problems don’t impact your personal matters.

No State Income Tax:

A major advantage of running a business in Texas is that there is no personal state income tax. Because Texas LLCs only pay taxes using their revenue, they are exempt from being taxed twice, as some corporations are.Check out how the Texas Comptroller’s Franchise Tax page

Flexible Tax Options:

By law, Texas LLCs are pass-through entities, so the owners receive the profits or losses and add them to their personal tax forms. Yet, LLCs in Texas also have the option to be taxed as C Corps or S Corps, which might be financially rewarding for your purposes.

Simplified Business Operations:

Texas makes things convenient for LLCs by not requiring a lot of bureaucracy. As a result, business owners get extra time to build their businesses instead of dealing with red tape.

Professional Image and Trust:

When you register your business as an LLC, you increase public confidence in your company. Your brand’s reputation will be enhanced by the “LLC” label, which shows that you take your business seriously.

For more detailed information, you can refer to the Texas Secretary of Texas Secretary of State – Business Filings Section.

Step-by-Step Guide to Forming a Texas LLC

Step 1: Choose a Unique Business Name

When you establish your business, choosing the appropriate name is very important. It should not have a name shared by any other company registered in Texas to prevent confusion. If your business name includes “LLC,” it clearly indicates that your company has limited liability protection. Avoid using restricted or prohibited words in your business name to prevent legal issues. Use SOSDirect to check business name availability and separate domain name search tools to find an available domain for your online brand.

Check for Name Availability

Conduct a search in SOSDirect Business Entity Search to ensure the name you want is still available. The name you pick must not look like any of the other names that are on the Texas Secretary of State’s list.

Follow Texas Naming Rules:

Texas requires that your business name include a designator such as 'LLC' or 'L.L.C.' to indicate its legal structure.

- “Limited Liability Company”

- “Limited Company”

- Sometimes, businesses are identified as “LLC” or “L.L.C.”

Using words like “bank,” “trust,” or “insurance” requires official approval. Also, your business name cannot imply affiliation with government agencies.For full naming regulations, refer to Texas Administrative Code §79.31

Get the Matching Domain NameMake sure your business name is available as a domain name to maintain brand consistency online. Getting a matching domain ensures you have a professional and regular brand name on the internet.

Pro Tip: A business name generator provides free suggestions when you struggle to find names. You can generate innovative business name suggestions using free tools designed for this purpose.

Step 2: Appoint a Registered Agent

Having a registered agent ensures that your LLC receives crucial legal and tax documents. The person or service must have an office in Texas where they are available from 9 am to 5 pm, Monday to Friday, to receive the documents. Having the right agent ensures you receive important business notices and meet deadlines. Although you can serve as your own registered agent, many business owners hire professionals for their reliability and added privacy, especially if they do not have a Texas office.

Here are some things to keep in mind while selecting a registered agent:

Reliability:

The person you appoint as your registered agent should be able to forward and handle important documents in a timely manner.

Business Hours Availability:

During their regular business hours, the agent should be present at the listed address to receive any official mail or notices.

Compliance with State Requirements:

According to Texas laws, the agent is required to have a proper physical place in the state and comply with requirements established by the Secretary of State.

An LLC cannot act as its own registered agent;

it must designate an individual or authorized service. Always verify that the professional registered agent service you choose is authorized to operate in Texas.

For complete guidelines, refer to the Texas Secretary of State’s Registered Agent Guide.

Step 3: File the Certificate of Formation

File the Certificate of Formation:

The Certificate of Formation is what you need to set up your LLC in Texas. Submit the document and the required fee online via SOSDirect or by mail to the Texas Secretary of State.

Provide Essential Business Details:

Your application should provide the LLC’s name, the registered agent’s information, the names of managing members or a manager and the company’s purpose.

Fill Out Form 205:

Complete Form 205 – Certificate of Formation for a Limited Liability Company to register your LLC. Either way, you can do this online using SOSDirect or mail the documents to the Secretary of State.

File and Pay the Fee:

A fee of $300 is needed to get your Certificate of Formation from the state. When applying online, pay by credit card. If mailing your application, include a check or money order payable to the 'Secretary of State.

Step 4: Create an Operating Agreement

Operating Agreement:

In Texas, an Operating Agreement is not required by law, but it is highly recommended for LLCs. It provides information on how your business should be run and who the owners and responsible workers are.

Why an Operating Agreement Matters:

Operational Structure:

An Operating Agreement is used to explain how your LLC will conduct business. It explains the roles of the leaders, how voting is done, the process for sharing profits and how matters of importance are settled.

Supports Limited Liability Protection:

Having a written Operating Agreement helps demonstrate that your business and personal affairs are separate, which supports maintaining your limited liability protection. Due to this distinction, only the company can be held liable for its debts or issues with the law.

Reduces Member Disputes:

Making each person’s responsibilities, authority and decision-making rules clear stops the partnership from experiencing disagreements. When instructions and processes are clearly recorded, fewer misunderstandings will happen.

Step 5: Get an EIN (Employer Identification Number)

An EIN is essential for tax purposes, opening a business bank account, and hiring employees. With this number, you can give job offers to employees, set up a business bank account and handle both federal and state tax issues.

How to Apply for an EINYou can get an EIN from the IRS without having to pay any fees. You can apply using any of the following methods:

- Online (Recommended): Apply quickly for EIN at IRS.gov

- Mail or Fax: Complete and send Form SS-4, which can be downloaded as a PDF.

Step 6: File the Initial Statement of Information

There are reports you need to file to match the state’s expectations.

Initial Statement

Texas LLCs are not required to file an Initial Statement of Information. However, there are certain filings you must complete to make your LLC official and keep it in good standing with the state.

What You Need to File:

Annual Franchise Tax Report:

Every year, all Texas LLCs are required to submit a Franchise Tax Report to the Texas Comptroller. By following this report, your business maintains a good relationship with the state.

Public Information Report (PIR):

In addition to filing the Franchise Tax Report, LLCs also have to file a Public Information Report. Here you will find the most recent information about all of the LLC’s officials and registered agents.

Step 7: Register for State Taxes and Obtain Licenses

If your business dealings change, your Texas LLC may be required to sign up for state taxes and gather necessary permits.

Sales Tax Permit

If the goods or services your LLC sells are taxable, you must get a Sales Tax Permit by contacting the Texas Comptroller of Public Accounts.

Franchise Tax

If your LLC earns more than the required amount in Texas, it will be subject to the Franchise Tax. To operate a business in this state, you must fulfil this yearly requirement.

Employment-Related Taxes

Firms with employees should register for state unemployment insurance and state income tax withholding. Individuals should register with the Texas Workforce Commission.

Licenses and Permits

Since Texas does not require a single business license for all businesses, your LLC may be required to obtain certain special state, city or federal permits depending on where and what you do. The Texas Business License & Permit Guide will let you know all the specific requirements that apply to your business.

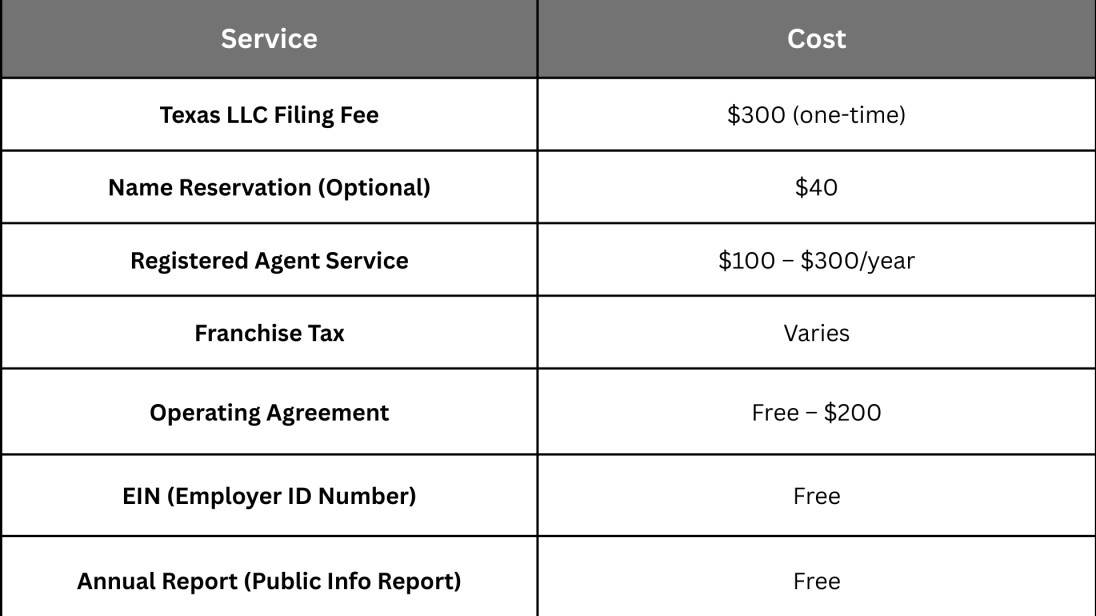

Cost Breakdown for a Texas LLC

4. Ongoing Obligations for Your Texas LLC

4.1 Annual Franchise Tax

A yearly franchise tax must be paid by every Texas LLC based on the company’s overall earnings. If your earnings are less than $1.23 million each year, your LLC is not required to pay taxes, but you must still file the annual report. After exceeding the threshold for income, you must pay the proper tax based on the income you make.

4.2 Report issued every two years

Texas entrepreneurs have to file a report with the Secretary of State every other year. The biennial report should reflect any changes in business officers and the company’s present address. You must file important documents on time to keep your LLC in good standing with the state.

Why Starting an LLC in Texas Could Be a Game Changer

Tap Into a Thriving Economy

Texas has a strong and varied economy compared to most other states. Because there are many thriving energy, tech, healthcare and manufacturing businesses in the state, there are plenty of customers. Startups and entrepreneurs are supported by Texas’s favorable business environment, helping them grow over time.

Personal Asset Protection

An LLC in Texas helps separate a business’s liabilities from a business owner’s personal finances. So if your company is sued or has debts, your home, savings and personal belongings are still safe, which gives you confidence as you expand your business.

Boost in Professional Reputation

Forming an LLC in Texas gives your business a stronger image among others. It demonstrates to individuals and organisations involved with your business that it exists and is dedicated. Companies want to establish themselves in Texas due to the favourable laws for businesses.

Is an LLC in Texas Right for You? Possible Downsides

Although there are several advantages to establishing an LLC in Texas, you also need to be aware of a few issues.

Franchise Tax Obligations

It is necessary for LLCs in Texas to pay the franchise tax every year. Despite the fact that some small businesses qualify for a “No Tax Due” filing, dealing with paperwork and costly fees can be stressful, especially since neighboring states are simpler.

Navigating Regulatory Complexity

Depending on your type of business and where it is, your Texas LLC could require following various regulations. The rules applied to these farms can be different and may not be easy to deal with without preparation. Because of their responsibilities, businesses and their owners may find it necessary to hire professionals who are skilled in meeting all requirements.

Ongoing Filing Requirements

Every year, you’ll have to submit the necessary reports to your state to maintain the good standing of your LLC. If you do not provide your information on time or hand in incomplete documents, your LLC could receive a penalty or face suspension until the issue is resolved. To ensure your business is respected and protected by the law, you should always focus on fulfilling your duties.

What Comes Next After Forming Your Texas LLC

After registering your Texas LLC, it’s important to take some further actions to ensure it is legal and safe:

Get an EIN (Employer Identification Number)

Be sure to obtain an EIN by following the steps set by the IRS. With your Employer Identification Number, you can take care of tax issues, recruit employees and establish a business account. You can apply for an EIN online.

Sign Up for State Tax Accounts

Referring to what your LLC does, it may require you to sign up for state taxes. If what you sell is taxable, you’ll have to obtain a permit from the Texas Comptroller of Public Accounts. If you are an employing organisation, you have to apply for employment tax registration.

Apply for Business Licenses and Permits

The general permits and licenses a business requires will differ according to its type and the area it operates. You may have to obtain approval from local regulators, the health department or authorities in your specific field to operate your LLC.

Keep Your LLC in Good Standing

To maintain compliance with the state, you must regularly submit biennial reports and pay the franchise taxes. Being well-organised and meeting your deadlines will help your business escape penalties or suspension.

Frequently Asked Questions (FAQs)

Q: Is a lawyer required when setting up an LLC in Texas?

Usually, individuals complete the process by themselves or go through an online service. Setting up an LLC in Texas is made easy even for non-experienced users. Even so, if your business involves multiple owners or threatens to face legal risks, you should consider working with a lawyer to make sure everything is organised optimally.

Q: How much time does it take to establish an LLC in Texas?

Fillings done online are approved between 3 and 5 business days, compared to mail filings, which can take as long as two weeks. Receiving a passport quickly does involve a fee, while the processing tends to be a tiny bit slower around holidays or times of heavy work in the offices.

Q: Am I able to complete the role of registered agent by myself?

You may act as a registered agent for your business, provided you live in Texas and have a fixed address and can be found during regular business hours. You will probably spend less on Poste Restante, yet you have to be there when your post arrives and always update your new address.

Q: Can someone who lives outside Texas still form an LLC there?

Being a resident of Texas is not required to begin the process of forming an LLC in the state. Entrepreneurs from Texas and non-Texas residents are allowed to create an LLC in Texas by assigning a registered agent who has a physical address in the state.

Q: Does an EIN stand for tax ID?

An EIN is a federal tax ID assigned to businesses in the United States. The IRS issues it, and you must have it to complete actions such as opening a business account, filing taxes and hiring labour.

Conclusion:

Building a firm and protected business begins when you start an LLC in Texas. Low prices, simple procedures and an improving economy give entrepreneurs many advantages in Texas.

Just use the regular steps, don’t miss any yearly deadlines and focus your efforts on expanding your business. Starting a company or growing an existing one in Texas can be made safer by choosing to form an LLC.

- Franchise Tax Report

- Public Information Report (PIR)