Are you dreaming about owning a business in Arizona?

Establishing your LLC the right way becomes the essential first step if you want to transform your business dream into reality, whether it’s a coffee shop in Phoenix or a tech startup in Tucson.

Many start their business ventures without clear knowledge of the proper steps, which leads to early problems. But don’t worry, you’re not alone. If you want to start an LLC in Arizona, this guide provides a straightforward path for forming your LLC without unnecessary stress.

The foundation of forming your LLC depends on numerous factors that extend beyond paperwork processing and name selection. You need to create authentic properties that belong exclusively to you. Ready to take that leap? Let’s walk through it together.

Table of Contents

- Choose a Name for Your LLC

- Appoint a Registered Agent

- Get the Necessary Business Licenses

- File the Articles of Organization

- Create an Operating Agreement

- Apply for an EIN & Handle Taxes

- Submit Annual Reports

- Who can start an LLC in Arizona

- Benefits of starting an LLC in Arizona

- Possible drawbacks of starting an LLC in Arizona

- What Makes an LLC a Better Choice for Your Business in Arizona?

- Conclusion

Choose a Name for Your LLC

Choose a name for your business because it requires creative freedom and legal groundwork. The creative aspect dominates the business naming job, but you will need to understand specific legal considerations.

The name of your LLC has to include an ending such as “LLC,” “L.L.C.,” “LLC,” or spell out “Limited Liability Company.” The state is able to recognise that your business is legally an LLC because of that.

However, you do not want to become attached to a name before ensuring that it is available or not too similar to another already registered business name. You can easily find that out in the Arizona Corporation Commission (ACC) because if your name sounds too similar to another one, it can be rejected.

By the way, here’s also a smart tip: If you aim to build a website (which let’s face it you most probably will anyway), try to find out if the domain name is also available. Attempt to blemish something that can coordinate with your business name, or something that will be close enough that individuals won’t puzzle when they look for you online.

Choose a Registered Agent for Your LLC

After choosing your name, your next task comes to choosing a registered agent. Sounds official, right? That’s because it is.

A registered agent is a person (or company) who receives critical documents or legal notices on your behalf, as a business. Consider them the LLC’s personal address to address any communication the state may send your way.

The catch? Your agent has to have a real, physical address in Arizona Corporation Commission (ACC) and have to be available during the normal hours of business, Monday to Friday. Regardless of who it is; you, someone you can trust, or a professional service, they should be reliable and easy to find.

Now let’s discuss how to pick the right box. Keep these points in mind:

- Dependability is key: It has to be dependable because this person or service will be dealing with sensitive, time-sensitive paperwork. You want to always count on him.

- Always available: They should always be available whenever their address is listed, and business hours roll around. No skipping out early!

- Legally compliant: Whomever you select must be virtually legally compliant.

Get the Necessary Business Licenses

Let’s go over something that you do not want to skip: checking to make sure your business is allowed to operate legally in Arizona. Whether it is licenses or permits, you’ll need certain papers before you’re actually allowed to roll out the red carpet.

They can range from a general business license to a more specific one related to your particular industry. For example, if you are going to start a food truck, salon, or auto repair shop, the rules and requirements for each are different.

Here’s what to do:

- Start by checking with both state and local agencies. Begin with a search at both the state and local levels. They’ll let you know exactly the type of permits that you will require for your type of business

- Fill out all the necessary forms. Send every form needed, filled out accurately it goes without saying to the right departments.

- Don’t forget about fees. Be prepared to include the cost of most permits in your startup budget.

For instance, you are about to start a car detailing business. To obtain your basic license, you will most likely have to register with the Arizona Commerce Authority’s Small Business Services first.

However, other permits may be involved depending on where you work and what services you provide. Also, make sure your workspace is in a commercial zone and meets safety and accessibility codes if customers will be arriving.

This part is, in fact, one of the easiest parts to get 100% right from the start and will save you all the legal headaches later. Believe me, it’s very much worth the effort.

File the Articles of Organization

With your name chosen and a registered agent in hand, your LLC will start to live. In Arizona, the best way to do this is by filing what is known as the Articles of Organization which creates your business's official entity.

Remember: This is to the Arizona Corporation Commission (ACC)— not the Secretary of State (another common one!) Filing online is easy, or you can mail it in paper form.

Here’s what you’ll need to include:

- Your LLC’s official name

- Your registered agent’s name and address

- Whether the members of your business will be managing it or the managers

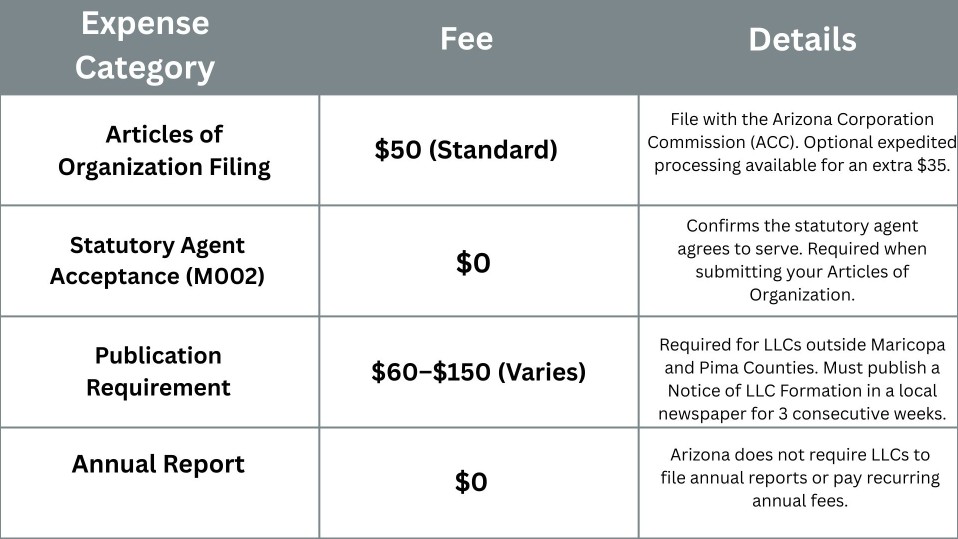

Form L010i is Arizona’s form LLC and the one you will need to file. After everything is filled in and double-checked you’ll send it in with a $50 filing fee.

By the end of it, your business is already starting to take legal shape.

Create an Operating Agreement

The operating agreement in Arizona stands as an optional tool that proves highly beneficial for LLC operations.

LLCs depend on their Operating Agreement for their rulebook to function properly. An Operating Agreement provides structure to state who possesses what assets and how to govern decisions while defining member departure rules and unexpected event procedures. An Operating Agreement serves as an important optional document in Arizona, but ensures everyone knows their roles with their business partners.

This document covers stuff like:

- The agreement demonstrates how members handle profit and responsibility divisions

- Each member’s role in the business

- The process for exit requests of business members and the dissolution steps in case of business closure form a crucial section within the document.

The written document removes possible misunderstandings and disputes that can arise later. This strategic move brings valuable reassurance during your business operation, whether you run the business alone or collaborate with partners.

Apply for an EIN & Handle Taxes

Obtaining an EIN serves the same purpose as a Social Security Number when it comes to your business.

Registering an LLC in Arizona requires an Employer Identification Number (EIN) after completing the establishment. A business EIN functions as the official identification number which serves both tax reporting and banking purposes.

There are three major situations where you must obtain an EIN for your business.

- Hire employees

- Open a business bank account

- File federal or state taxes

- You should maintain separate business finances from personal finances, even if it means nothing else (however, maintaining separate finances is essential)

Good news? One can obtain this service totally free by applying through its website . An EIN application process can be started through the mail but will require additional time when compared to the online application.

Getting the EIN resolve check requires assessing your tax requirements at the same time. Running an LLC in Arizona requires attention to both sales tax obligations for product sales as well as self-employment tax contributions that equal 15.3% for Social Security and Medicare coverage.

Want to make sure you’re handling taxes the right way? A quick visit to the Arizona Department of Revenue can help you stay on top of what applies to your specific business.

Submit Annual Reports

An annual report is something that a lot of new business owners trip up on. Most states require LLCs to file these annually to stay in good standing with the government.

Luckily, if you are creating your LLC in Arizona, you will start at a reasonable advantage.

Normally, Arizona doesn’t require you to file annual reports for most LLCs (unless your organization is a sole proprietorship or partnership). So, that takes a load off when it comes to one less form to be mindful of and one less time to keep track of deadlines each year.

While you should still maintain your internal records current, at least you do not need to hand in anything formal to the state each year. One of the perks of starting a business in Arizona Commerce Authority’s Small Business Services!

How much does it cost to start an LLC in Arizona

Who can start an LLC in Arizona

First, of course, you should verify that you’ve ticked all of the boxes before forming your LLC. Things are kept simple enough in Arizona, but one will want to know the rules first.

First, you must be at least 18 years old. In the state, the minimum age to legally begin an LLC is 18.

Don’t live in Arizona? No problem. There is no Arizona residency requirement to form an LLC in this state. However, you need a registered agent with a physical address inside the state that can receive official mail and legal documents for your business.

Not a U.S. citizen? Still okay. Foreign nationals are allowed to form an LLC in Arizona. It does not have to be a citizen or a green card holder.

Moreover, LLCs are suitable for most kinds of businesses and objective: you want to run a shop, provide services etc. or you sell online. However, if you belong to the profession that demands a professional license (for example, law, medicine, or accounting), you must register as a Professional Limited Liability Company (PLLC).

Lastly, your LLC can be simply you, that is, a single member, or a bunch of people, multi member. But you’ve got flexibility because there is no upper limit of how many members you can have.

Benefits of starting an LLC in Arizona

Establishing an LLC in Arizona currently seems like a smart business move for many entrepreneurs. Many entrepreneurs choose LLC formation since it provides several advantages.

You get personal protection

One of the biggest perks? Limited liability. Your personal possessions consisting of car, home and savings will usually stay protected when things go wrong for your business such as lawsuits or debts. Using an LLC protects your business assets from the things that affect your personal assets.

Fewer tax headaches

Pass-through taxation benefits all ordinary business LLCs. Business operations without separate taxation protect your business entity from individual taxation. Your personal tax return receives all business earnings and losses which pass through from the business operations. No double taxation, just one layer.

Flexible management style

There are no set corporate restrictions in this business. Through an LLC you have choices to either handle operations yourself or recruit management personnel to assist you. Your success requires finding the best organizational structure which suits your individual needs.

Easy to set up (and keep running)

Business formation through an LLC demands less effort compared to setting up a corporation. The administrative process stands simpler while you will escape overwhelming legal obligations annually Arizona Secretary of State’s website.

Boosts your business image

Your business appears more professional when you add the "LLC" designation at the end of your name, since customers and banking institutions view it as a sign of professional commitment. An LLC domain purchase for your website provides an additional opportunity to enhance your business professionalism.

Possible drawbacks of starting an LLC in Arizona

You should evaluate both positive and negative factors before starting the process of Arizona LLC registration. Understanding the difficulties beforehand allows you to determine whether your business needs this structure. Several negative aspects of running an LLC in Arizona deserve consideration.

Paying Taxes on Your Own Income

As an LLC member you become responsible for paying the self employment tax when receiving profits from business operations. Social Security and Medicare taxes and other related contributions accumulate because the success of your business generates more income.

Harder to Scale Like a Big Business

LLCs differ from corporations because they lack the ability to create stock options for fundraising purposes. The path to securing outside investors may become more complicated. The ability to quickly scale your business may be restricted if you choose this structure.

Changing Ownership Isn’t So Simple

Changing ownership in an LLC requires more steps than the straightforward process of passing shares amongst shareholders' incorporation structures. All members of an LLC typically need to vote on new member additions and changes in ownership distribution. Your future investment plans requiring new investors could entail additional processes with Arizona Corporation Commission systems.

Rules Change If You Work Across States

State laws regulate LLCs, while their specific regulations between states can differ substantially. Your plan to expand or operate within multiple states can encounter challenges since each state enforces distinct rules and regulations regarding LLCs.

What Makes an LLC a Better Choice for Your Business in Arizona?

Deciding the business structure represents a critical decision for new business owners. Lots of Arizona business founders choose the LLC business structure mainly because of the special advantages it provides. You need to understand the advantages and disadvantages of LLCs when compared to other business types before picking one, because it affects your business choices.

The comparison below reveals how an LLC performs in contrast to various other commonly used business types:

More Protection for You

The protection available for your personal property ends with a sole proprietorship since all assets combine in a single pool. Legal troubles or debts impacting your business may put your personal property, including your home and savings, at risk. The IRS website provides protection for your personal assets through an LLC structure, which separates business assets from personal ones.

Co-Founding

When you establish your business together with partners through co-founding each member assumes liability for company debts. Your personal financial assets are vulnerable if your business faces problems, since you have no protection. The structured protection of an LLC protects each member so their personal finances remain untouched by business debts.

Enterprise

Enterprise entities have the same personal asset protection of LLCs yet they undergo the drawback of double taxation. The business incurs taxation on its profits before its shareholders must pay dividend income tax from their share distributions. An LLC benefits from pass-through taxation which distributes both profits and losses between its members to prevent double taxation.

Conclusion

If you are an entrepreneur, it is a smart and strategic move to form an LLC in Arizon. An Arizona LLC gives you numerous key benefits, such as personal asset protection, tax flexibility, and constantly taking tax deductions and exemptions for themselves and their family members. Setting up a business is relatively easy, as long as you know how to name the business, file the correct paperwork and understand the local requirements. An LLC offers a lovely mix of liability protection and the tax advantages of other structures, such as sole proprietorships, partnerships, and corporations, while breaking the formality of all of these structures. However, while there are some challenges to think about – like self-employment taxes and limited capability to raise funds- the pros make it a good choice for several types of business owners wanting to thrive in Arizona’s business environment.