Florida is full of opportunity, and forming an LLC is the gateway to securing your business's future.

Start an LLC in Florida establishes protection for your personal assets together with automated paperwork management and tax advantages as one of its key advantages.

Business owners choose LLCs because they receive solid legal protection, together with simpler organizational requirements than corporations. The multiple perks associated with it make this option the preferred choice for business owners.

This instruction manual presents a detailed guide on forming an LLC in Florida in 2025 by showing procedures for business name selection and Sunbiz filing and state regulations compliance steps. You can easily create your Florida LLC through step-by-step instructions provided by Sunbiz, the IRS and trustworthy formation services that follow clear directives from the Florida Department of State.

Table of Contents

- Understanding LLCs in Florida: Why It’s a Smart Move

- Step-by-Step Guide to Forming Your Florida LLC

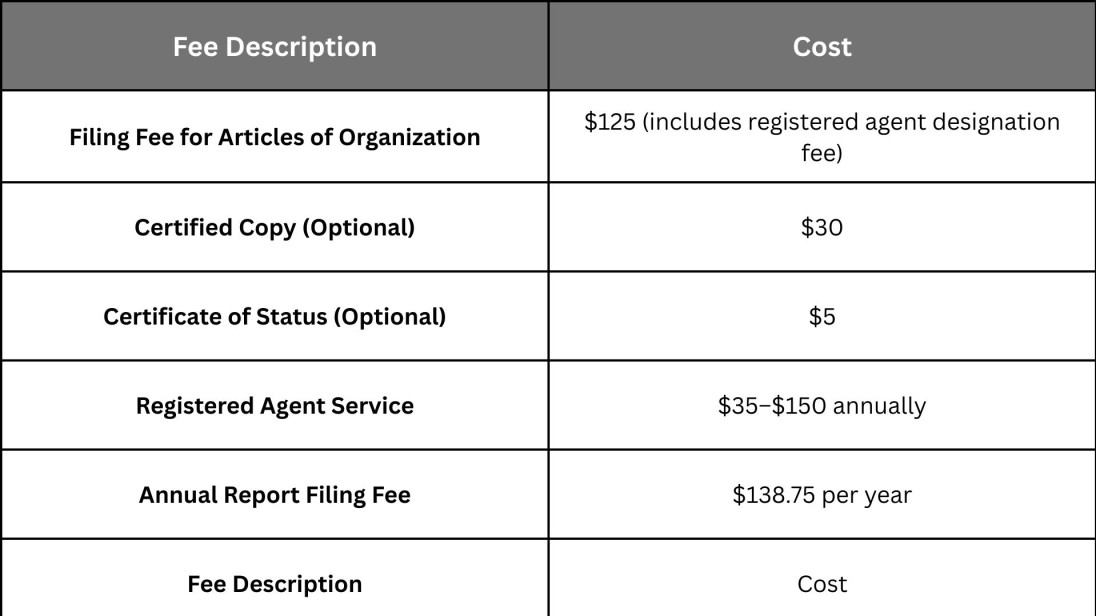

- Pricing Information for Creating an LLC in Florida

- Why Starting an LLC in Florida Could Be a Game Changer

- Is an LLC in Florida Right for You? Potential Drawbacks

- What to Do After You’ve Set Up Your LLC in Florida

- Frequently Asked Questions (FAQs)

- Conclusion: Ensuring Your LLC is Legally Protected

Understanding LLCs in Florida: Why It’s a Smart Move

A business owner who wants to protect themselves legally and reduce tax liabilities, and maintain business control, should consider setting up a Florida Limited Liability Company (LLC).

Top Benefits of Forming an LLC in Florida:

Shielding Personal Assets: Liability protection stands as the primary benefit of creating an LLC in Florida. Your property, along with your personal finances, stays distinct from your business legal obligations, thus protecting you from financial consequences when debts or lawsuits arise.

Favourable Tax Treatment: Business income obtained from Florida LLCs passes through taxation because members pay taxes on this income when they file their personal returns. Florida residents enjoy double benefits because multiple exemptions allow their earnings to grow, because they do not pay state income tax.

Flexible Management Options: This type of entity does not force you to follow strict regulations. All management roles within a Florida LLC either fall to the members or they can choose responsible outside professionals to run the business. Full operational freedom exists under this structure since the members determine both profit distribution and business operations.

Starting an LLC in Florida provides business owners with enhanced control and business flexibility together with the ability to build their enterprise with assurance.

Step-by-Step Guide to Forming Your Florida LLC

2.1. Choose a Unique Business Name

All Florida businesses that form LLCs need to choose their business name first, as long as it fits their brand identity and follows state naming requirements. The selected name for your LLC requires a legal addendum that includes “LLC,” “L.L.C.” or “Limited Liability Company.”

The process to obtain a valid and distinctive LLC name in Florida requires these procedures:

- Verify Name Availability: Every Florida business must check their desired name availability through the Sunbiz Business Search tool to prove that their name isn't already registered as a Florida business.

- Follow Naming Guidelines: Your business name should not suggest governmental involvement since terms including “Agency,” “Commission,” “Department”, or “Board” typically demand additional documentation or face restrictions.

- Secure Your Online Presence: Make sure your domain name matches your LLC name and is open for purchase. Owning a domain offers brand design consistency between all your digital platforms.

Helpful Hint: Business name generators can help companies generate possible names which support their goals when they struggle to develop unique names.

2.2. Appoint a Registered Agent for Your LLC in Florida

Registered Agent Florida requires all LLCs to choose a registered agent who will receive legal and state documents on their behalf. Florida law demands that registered agents use physical addresses in the state instead of P.O. boxes for proper document delivery.

When appointing a registered agent, keep the following points in mind:

- Dependability: Use dependable people or certified professional services proven to handle legal documents securely.

- Availability: Your registered agent needs to stay available during business hours at the listed address because that is where official notifications and court documents need to be sent.

- Legal Qualifications: Check that the professional service has all the necessary permissions to do business within Florida. Florida rules prohibit an LLC from using itself as a registered agent. Companies choose to use professional registered agent services because these providers meet all Florida business regulations and maintain constant availability.

2.3. File Articles of Organisation to Form Your Florida LLC

You must submit Articles of Organization documents to the Florida Division of Corporations to receive your LLC's legal existence. This essential document contains all crucial details about your business operations.

To finalize this step, follow the actions below:

Gather Required Details:

- You must present the correct legal title of your LLC accompanied by its designated suffix either LLC L.L.C. or Limited Liability Company.

- Principal office address

- Registered agent’s name and Florida-based address

- Picking member-manager control or manager-manager control for business operations.

Filing Options: Submit your Articles of Organization either by using the Sunbiz e-File Portal or through regular mail service to the Florida Division of Corporations.

Filing Fees:

- Standard filing fee: $125

- Optional certified copy: $30

- Optional Certificate of Status: $5

The state of Florida establishes your LLC as a legal entity through this step.

2.4. Create an Operating Agreement for Your Florida LLC

Despite no legal need for it, Florida companies should still create an operating agreement because it benefits their business practices. This private document explains how your organization functions and who owns the company, while establishing control measures when problems occur.

Why you should create one:

- Establishes Internal Structure: It determines how each member should perform their duties and makes clear where decision-making power goes plus distribution methods for profits and losses.

- Maintains Legal Protection: Your LLC and its owners operate separately because the operating agreement shows how the company provides protected legal standing.

- Avoids Conflicts: Written rules help members stay united and follow the procedures set by their company.

Creating and using an operating agreement establishes fundamentals that make business operations run better.

2.5. Apply for an EIN for Tax and Banking Purposes

Employer Identification Number (EIN)Your LLC uses an EIN as its official business Social Security equivalent to perform financial transactions and meet legal tax and hiring requirements. You must get this ID to run your business including bank account setup and payroll management.

Steps to get an EIN: Both online access to the IRS website and submitting Form SS-4 through mail or fax allow free processes to obtain an EIN.

Know your tax duties:

- Federal Taxes: LLC members must pay 15.3% taxes as self-employment, which covers 12.4% for Social Security and 2.9% for Medicare.

- State Taxes: Florida Business Owners Do Not Have To Pay Personal Income Tax But They Need To Follow Sales Tax And Filing Requirements. Check the Florida Department of Revenue for specific requirements.

Having a business EIN early will help you prepare your financial accounts tax paperwork and payroll operations.Apply for free through the IRS EIN portal.

2.6. Secure the Right Licenses and Permits for Your Florida LLC

Business Licenses Florida demands particular business licenses or permits based on your business type and geographic location within the state.

Follow these steps to comply:

- Research Requirements: To determine necessary licenses use the Florida Business Information Portal guide for business activities and local requirements.

- Industry-Specific Licensing: Certain industries such as construction, real estate or food services require applying for licenses through Florida DBPR.

- Pay Applicable Fees: Complete and submit the necessary forms alongside paying any needed license costs when you apply for permits.

2.7. File the Florida LLC Annual Report to Stay Compliant

Annual Report Filing Every operational LLC in Florida must submit their annual report to the state to stay active.

Important information:

- Deadline: Your Florida LLC needs to submit its annual report every year from January 1 to May 1 to maintain its active status.

- Filing Fee: The basic report charge stands at $138.75 for our service.

- Where to File: You must send your reports to the Florida Annual Report Portal.

On-time annual report filing keeps your business active under the law by preventing unwanted penalties and ensuring company survival.

Pricing Information for Creating an LLC in Florida

Why Starting an LLC in Florida Could Be a Game Changer

Florida is an appealing location for startup owners because its good economy supports companies and offers legal protection. Here’s why many entrepreneurs choose Florida:

- Broad Market Reach: The people in Florida can build successful businesses within tourism services plus other industries like property, medical care, farming and technology. Different industries make it possible for startups to develop their business in multiple target markets across Florida.

- Tax Benefits: Your business keeps more money since Florida offers no individual state income tax on profits.

- Business-Friendly Policies: Business owners find Florida promising because its business environment has minimal regulations that simplify their startup operations.

- Professional Image: Starting your Limited Liability Company as an LLC improves your image while operating in Florida. The design adds trustworthiness to your business profile when you work with business associates and investors.

River Run Services will find excellent growth opportunities no matter where they start their business in Florida.

Is an LLC in Florida Right for You? Potential Drawbacks

Possible Limitations: Florida gives lots of benefit,s but you must know what an LLC owner needs to do under Florida law and accept the risks when setting up business here. Be aware of the following considerations:

- Annual Filing Obligations: Each Florida LLC needs to submit their annual report to the state. A missed filing deadline may lead to penalties or force the state of Florida to end your business operations.

- Licensing Complexity: Obtaining legal operating permits depends on how your business works and where it does business. Specific government rules and business sector guidelines make LLC establishment more challenging for states and specific business industries.

- Legal and Regulatory Hurdles: Organizations that work in certain industries must obey strict legal principles that need assistance from professional lawyers. Regulations for building projects and the food industry operate in layers that make compliance difficult, especially in medical services.

Thinking about both benefits and drawbacks will show you if a Florida LLC matches your business plans and finances.

What to Do After You’ve Set Up Your LLC in Florida

Post-Formation Steps A new Florida LLC must begin these vital actions to keep their company legally accepted and ready to work:

- Apply for an EIN: A business needs its Employer Identification Number to function the same as a Social Security number. A business bank account needs this ID to help you employ staff and handle taxes. You can obtain an EIN free of charge by submitting your application through the IRS website.

- Register for Florida State Taxes: Different business types must register for state taxes, including sales tax, reemployment tax and corporate income tax, depending on their industry. You must check Florida Department of Revenue taxes for your business type and follow their registration steps.

- Secure Required Licenses and Permits: Florida state and local authorities require you to obtain necessary business permits before legal operation. Your business will need particular licenses, including health department permits and professional credentials, to operate successfully. Check the Florida Business Information Portal for assistance, and contact the Department of Business & Professional Regulation for professional help.

- Keep Your Business in Compliance: An LLC maintains its status when you submit timely annual reports plus keep all business records updated. You need to meet state requirements on schedule and comply with rules to stay away from fees and keep your LLC running. Get online instructions to file your annual report from the Florida Division of Corporations.

Frequently Asked Questions (FAQs)

1. How do I get an LLC in Florida?

Submit the Articles of Organization through Sunbiz.

2. Do I need a lawyer to form an LLC in Florida?

No. You only need a lawyer when your business setup continues or when you require legal guidance.

3. How much does it cost to start an LLC in Florida?

At least $125 for the filing, plus $138.75/year for your annual report.

4. Do I need an Operating Agreement in Florida?

Creating the document is not mandatory, but generating it will greatly improve your operating results.

5. Can I be my own registered agent?

You can serve as your own registered agent as long as your company keeps a physical presence in Florida during regular business hours.

Conclusion:

Business owners in Florida should establish LLCs to earn asset protection and tax benefits through enhanced business credibility. Use this process properly while fulfilling your yearly duties to establish a firm legal basis for your company. Review state laws on a schedule and update your business records to prevent problems from developing unexpectedly. Your Florida LLC can thrive in business competition when you build a proper organizational setup ahead of time.