Forming an LLC in Indiana allows your business a proper legal groundwork to thrive with a sense of security.

It ensures your personal belongings, your home, car, and savings, if things turn out bad with your business. Thus, you do not have to worry about risking everything you have to achieve your business goals.

This is not a wall of legal text. It’s designed to guide you through every step clearly, whether you are starting with your first idea or changing tack with a current plan.

Are you Looking how to setup an LLC in Indiana? You’ve come to the right place! We have included official resources, useful instruments, and pertinent insights to help you register your business properly.

Let's get started!

Table of Contents

- Why Start an LLC?

- Step-by-Step Instructions to Form Your Indiana LLC

- Breaking Down the Costs

- Tips for Long-Term Business Success

- Frequently Asked Questions (FAQs)

- Final Thoughts and Next Steps

Why Start an LLC?

Creating an LLC in Indiana separates your personal assets from business liabilities, providing legal and financial protection if your business faces challenges.

An LLC does not mix your personal and business obligations, unlike in the case of a sole proprietorship. This means that in case your business collapses, your house, bank accounts, or car won’t be affected.

Besides, with a pass-through taxation, the profits are taxed only once with the help of the personal income tax return, and avoiding the double taxation they can be subject to in corporations.

You also gain more credibility when it comes to dealing with clients, partners, or banks. And the best part? Having an LL is not as difficult and costly as one may think.

To get a full understanding of LLC advantages in Indiana, you can visit the Indiana Secretary of State's Business Services Division.

Step-by-Step Instructions to Form Your Indiana LLC

1. Choose a Name for Your LLC

The name of your LLC is your image to the world. Ensure that it’s unique, compliant and available.

- Make It Unique: Check with the Indiana Business Name Search Tool to see if your name is available for use. It helps you to prevent legal conflicts and delays when registering. If the name is already chosen, then you can add a keyword about your business.

- Use the Required Ending: Your business name also needs to use “Limited Liability Company,” “LLC”, or “L-L-C”. This means that your business is a legitimate LLC. There are formats that best suit your brand style; choose where you feel comfortable.

- Avoid Restricted Terms: Take care of being professional in your choice of words such as ‘bank’ or ‘insurance’ unless you have special needs. Here is a link to the full naming rules in Indiana’s Business Naming Guidelines.

- Check Domain Availability: You’ll also desire your company name to be a free domain for your website. Check using tools such as GoDaddy or Namecheap. Having the same domain makes it easier for customers to find you online and makes you more credible.

Helpful Hint: Business name generators assist firms in creating suitable name options for organisations that face difficulties generating distinctive names.

2. Appoint a Registered Agent in Indiana

A registered agent is a person who accepts official government notices and legal correspondence on behalf of your enterprise. They ensure that you do not miss important documents that you may need, such as tax notices, lawsuits, or state filings.

To qualify, your registered agent must:

- Reside in Indiana or be a company allowed to operate in IndianaThis makes sure they are legally permitted to represent your business to the state.

- Own a phone (this doesn't necessarily need to be a mobile phone)The state calls for a physical street address so that documents can be hand-delivered, if necessary.

- Consider being on call during normal working hours.Your agent should consistently be able to receive mail on Monday-Friday, usually from 9 AM to 5 PM.

However, you may also be your own registered agent, but in most cases business owners appoint a professional service to manage the privacy and not miss any detail. Learn more on the Registered Agent Requirements page.

3. File Your Articles of Organization

Legal Formation

Legally organising your Indiana LLC requires filing the Articles of Organisation with the Secretary of State. After submitting and processing the papers, your business is legitimised in Indiana.

How It’s Done:

- Gather Basic Info: Pull such information as your LLC name, street address in Indiana, registered agent information, and the purpose of your business.

- Fill Out Form 49459: This is an Indiana’s articles of organization form. You can submit it online on INBiz or mail it.

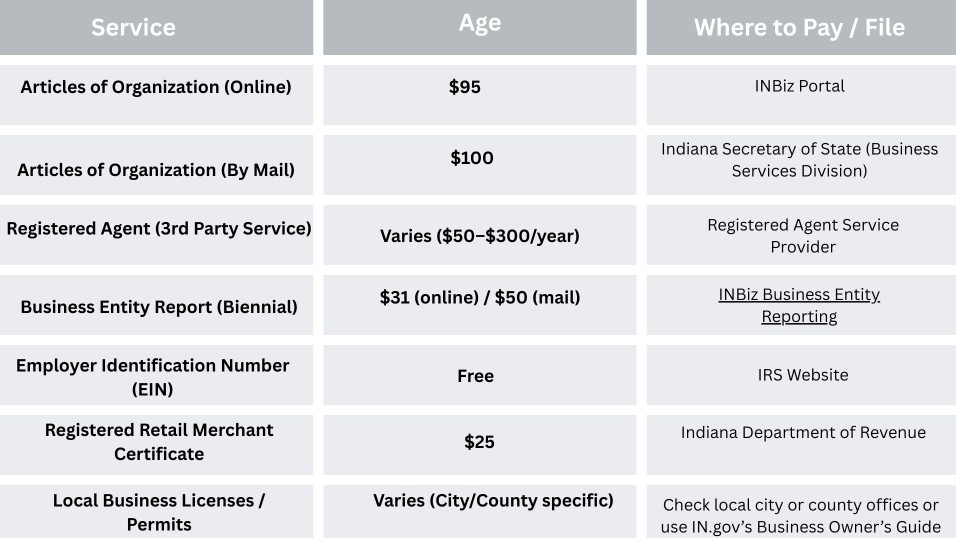

- Pay the $95–$100 Fee: The fee for filling online is $95, whereas by mail is $100. Payment is to be done when submitting a return.

Once the Secretary of State processes and approves your filing, your LLC is active, finally active. Do not forget to have a copy of the approved form for your files.

4. Create an Operating Agreement

Actually, Indiana does not require the use of an operating agreement, but it is always best to have one.

This internal document describes your business structure, member roles, and financial arrangements.

Why it's helpful:

- Defines each member’s responsibilities

- It illustrates the fate of profits and losses.

- Prevents future disputes

- Demonstrates to the bank and other spending partners that your LLC is solid and structured.

You may write one yourself, or seek the help of a lawyer. LegalZoom and Rocket Lawyer are other sources of templates.

5. Get Your Employer Identification Number (EIN)

An Indiana LLC is required to have a federal tax ID, commonly known as an EIN (Employer Identification Number) to legally conduct business. This figure is crucial to deal with taxes, banking, and employment of employees.

How to Apply:

- It’s Free and Fast: You have the option to apply for your EIN free of charge online using the IRS EIN Application page. Having an EIN applies directly with the IRS, which is free of cost; third-party companies are not required.

- Use It for Everything: Your EIN will be used for filing taxes, opening a business bank account and running payroll, among others.

6. Apply for Business Licenses and Permits

To legally operate your Indiana LLC, you may require some state or local licenses based on your field of activity and the area of operation. Getting the right permits also gives your business a spin.

Here’s How to Get Them:

- Know State Requirements: Register with the Indiana Professional Licensing Agency to learn the types of professions and services that require a state-issued license.

- Review Local Guidelines: Call your area city or county clerk’s office to learn local permit rules per your region.

- Submit Your Applications: Fill out and mail the required forms with any relevant fees. This deadline is not optional, failure to submit it can result in late charges or even the administrative dissolution of your LLC, so do not forget about it.

7. File Your Biennial Business Annual Report

For maintaining your Indiana LLC active, you are required to file a business report every two years. It updates your company’s record with the state.

What You Need to Know:

- Details Required: Update the business name, principal office address, and registered agent.

- Filing Fee: When filing online, $50, but $32 if filing by mail.

- Where: File through INBiz

- Deadline: Annually, usually every two years, on the anniversary month of your LLC’s formation. It may end up with penalties or the dissolution of your business status if you are late.

Breaking Down the Costs

Tips for Long-Term Business Success

Our services for your LLC do not end after registering it. These are some of the best practices that facilitate long-term growth.

- Keep Finances Separate: Create a special business bank account where your money stays organized and you don’t face problems that are not related to articles and organizations.

- Insure Your Business: Make sure you have adequate small business insurance. Consult the Indiana Department of Insurance to explore options.

- Document Everything: Track your business decisions, contracts, and financial records to remain prepared for tax time or audits.

- Stay Compliant: Keep on top of biennial reports, licenses, and tax filings. Make a bookmark of the INBiz site for easy access.

- Build a Strong Online Presence: Go online and have a web presence by creating a professional website and being active on social media so you can reach your customers.

- Network and Grow: The other solution is that individuals who want to venture into business should join local chambers of commerce or business groups in Indiana where they can receive support, attract customers and opportunities that they could benefit from.

- Seek Professional Guidance: Use evaluators or legal counsel to safeguard your business and make better decisions.

Frequently Asked Questions (FAQs)

1. What is an LLC and why should I create form one in Indiana?

An LLC is the best entity since it protects your personal possessions from business risks and debts as well as has tax advantages in Indiana.

2. How much does it cost to register an LLC in Indiana?

The cost of filing an Articles of Organization varies depending on the method of filing, and it is $95 if filed online while it is $100 for filing through mail.

3. How long does it take to established an LLC in Indiana?

The state takes 3-5 business days to register an LLC when the process is done online. Mail submissions may take longer.

4. Do I need a registered agent for my LLC in Indiana?

Yes, your LLC is required to have a registered agent that resides in Indiana with a physical address to take delivery of official documents from the government and others.

5. Do I need an EIN for my LLC in Indiana?

Yes, you require an EIN in order to open a business bank account, file taxes, and also for hiring employees. It is available on the internet whereby you can access it through the Internal Revenue Service website.

Final Thoughts and Next Steps

Indiana LLC formation affords your business the best legal status as well as a foundation upon which you can base its future development.

Instead of going through the motions of the process, with every step completed, you are ensuring a solid foundation that will guarantee the success of your endeavour.

Keep learning, staying organized and relying on official resources such as INBiz or the IRS to keep the progress on, it’s your turn to make the business dream come true, but don’t forget to do it right.