Considering setting up your business in the state of Ohio?

A solid foundation is key, which is why this guide has all the information you need to get your business off to the right start.

Creating an LLC in Ohio provides a basis for any business owner, freelancer or independent professional to operate confidently. You can effectively run your business and shield your private assets from any potential business debts.

The State of Ohio has streamlined the LLC creation process, as long as a few key requirements are met. This guide covers everything from naming your LLC to keeping up with state regulations to officially and successfully establishing your LLC in Ohio.

Follow this step-by-step guide to help you form your Ohio LLC in 2025 with ease and confidence.

Table of Contents

- Understanding LLCs in Ohio: Why It’s a Smart Choice

- Step-by-Step Guide to Forming Your Ohio LLC

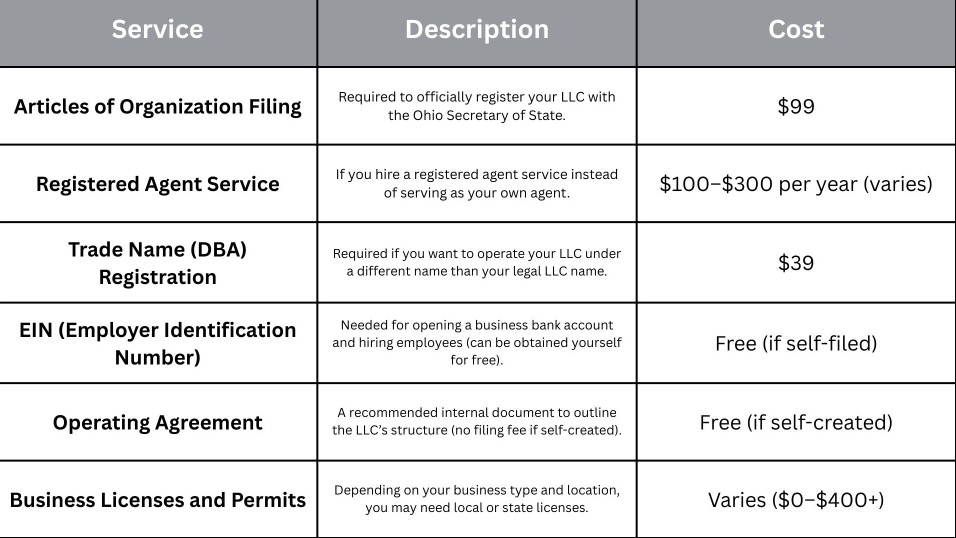

- Pricing Information for Creating an LLC in Ohio

- Ongoing Requirements for Your LLC

- Who Can Start an LLC in Ohio?

- Why Starting an LLC in Ohio Could Be a Game Changer

- Is an LLC in Ohio Right for You? Potential Drawbacks

- What to Do After You’ve Set Up Your LLC in Ohio

- Frequently Asked Questions (FAQs)

- Conclusion: Ensuring Your LLC is Legally Protected

1. Understanding LLCs in Ohio: Why It’s a Smart Choice

An LLC offers the personal asset protection of a corporation and the ease of a sole proprietorship. Choosing an LLC in Ohio offers entrepreneurs the advantage of liability protection, simpler tax management and increased flexibility in running the business.

Benefits of Choosing an LLC in Ohio:

- Limited Liability: Owners are protected against any liabilities or claims filed against the business.

- Pass-Through Taxation: Profits are claimed on individual tax forms, eliminating the need for double taxation.

- Less Paperwork: There is less paperwork and maintenance to be done compared to running a traditional corporation.

- Enhanced Credibility: Many clients, suppliers, and partners consider establishing an LLC to be a more professional business practice.

2. Step-by-Step Guide to Forming Your Ohio LLC

2.1 Choose a Unique Name for Your LLC

Ohio law mandates that your LLC’s name is different and easily identifiable from other registered entities in Ohio. The name should also contain “Limited Liability Company," “LLC," or “L.L.C.” First, check the Ohio Business Name Database to confirm your chosen entity name is free to use. Make sure your LLC name doesn’t contain terms or phrases that suggest a connection to the government, banks, or insurance providers. Also, ensure you can claim the domain name you want so it aligns with your brand across all digital platforms.

Helpful Hint: A business name generator is a useful tool for generating inspirational names when it is challenging to come up with a unique, suitable name.

2.2 Appoint a Registered Agent

All Ohio LLCs are required to appoint a registered agent who will accept legal and state documents for the LLC. An eligible registered agent must either live or do business within the state. You may serve as your LLC’s registered agent, but hiring a professional service helps ensure important papers are collected when you’re away or have businesses in other locations. This designated individual or entity helps ensure you stay in good standing with the state and shields your LLC from any potential issues related to business operations.

2.3 File Articles of Organization

Form your LLC by submitting the Articles of Organization to the Ohio Secretary of State. You can file your Articles of Organization online or through the mail, with a payment of $99. Make sure to provide information on your LLC’s name, physical address, nominated registered agent, and the way in which your business is managed. After approval, the filing gives your LLC the legal status it needs to start conducting business and routinely meeting necessary legal and administrative requirements.

2.4 Create an Operating Agreement

Ohio law doesn't require an Operating Agreement but having one is very beneficial and advisable. It specifies how your business operations work and describes the allocation of profits and losses as well as rules governing decision-making among members. It explains the duties, responsibilities, and ways for resolving disputes of each member. An Operating Agreement prevents future disputes and serves as a guide if an ownership situation changes.

2.5 Get an EIN from the IRS

An Employer Identification Number (EIN) is assigned to your LLC by the IRS website and is used as your company’s federal tax ID. You’ll need an EIN when you want to hire employees, open a business bank account or apply for business permits and licenses. Your LLC has advantages by getting an EIN, even if it’s solely owned and doesn’t employ any staff. Getting an EIN online is free and simple, and it’s essential for opening bank accounts, hiring employees, and handling taxes.

2.6 File Biennial Reports (No Initial Report Needed)

In Ohio, new LLCs aren't obligated to submit a report after formation. Every two years, you must return a biennial report to keep your LLC in good standing. Paying the $99 Articles of Organization fee is a one-time cost and does not cover the biennial report requirement. These reports ensure your business profile remains accurate and ensure the Secretary of State has accurate records of your registered agent and contact information. Neglecting to submit the report can lead to fines or the forfeiture of your company’s existence.

2.7 Register for State Taxes & Licenses

Depending on your business type, your LLC may need to register for state taxes and secure specific licenses or permits. You must obtain a Vendor’s License from the Ohio Department of Taxation if you sell items that are subject to state sales tax. Employers in Ohio must register with the Ohio Department of Job and Family Services (ODJFS) to pay payroll taxes. Also, reach out to your city or county offices for any additional business permits, health regulations or zoning requirements that pertain to your type of business and physical location.

3. Pricing Information for Creating an LLC in Ohio

4. Ongoing Requirements for Your LLC

4.1 No Annual Franchise Tax

Not having to pay an annual franchise tax is a significant advantage when choosing to form an LLC in Ohio. You’ll save yourself from continuously paying an ongoing maintenance fee, like in most other states. For entrepreneurs starting out and business expansions, Ohio stands out due to its lack of ongoing state franchise tax. You’ll be able to put a greater portion of your earnings toward growing your business instead of sending them to the state as regular taxes.

4.2 Biennial Report Filing

To keep your LLC in good standing:

- File every two years

- Confirm/update your business and registered agent details here Biennial Statement

- When deadlines go unmet, your LLC may be administratively dissolved.

5. Who Can Start an LLC in Ohio?

18-year-olds in any country can start an LLC in Ohio by following the appropriate state guidelines. As a result, Ohio welcomes entrepreneurs of all backgrounds to set up their businesses. The state requires all LLCs to have a registered agent with a physical address in Ohio. Make sure to comply with all Ohio and federal rules pertaining to taxes, labor and specific business licensing.

6. Why Starting an LLC in Ohio Could Be a Game Changer

Ohio has many benefits that can attract entrepreneurs looking to set up their own LLCs. Being in the middle of the country allows for convenient shipping and delivery to customers from a wide variety of regions. Ohio has a wide range of industries including healthcare, technology, manufacturing and agriculture. Ohio offers various resources and programs to support new business owners, helping with funding, training, and networking. Ohio also stands out by offering some of the lowest start-up costs and no yearly franchise tax for LLCs.

7. Is an LLC in Ohio Right for You? Potential Drawbacks

Ohio offers many advantages to business owners, but you should also keep these in mind:

- Commercial Activity Tax (CAT): Once your LLC generates over $150,000 per year, it's subject to an additional tax.

- Licensing Complexity: The type and number of permits you’ll need will depend on the specifics of your business

- Biennial Reports: Failure to file them could result in your LLC losing its status as a legal business entity

8. What to Do After You’ve Set Up Your LLC in Ohio

Once your LLC is formed:

- Establish a business checking account to keep the money flowing for business-related transactions only

- Secure the necessary licenses or permits for your business in Ohio.

- Develop your brand identity by creating a business website, obtaining insurance, and advertising your offerings.

- Keep detailed records of your income and expenses from the very beginning to make tax preparation easier in the future.

9. Frequently Asked Questions (FAQs)

Q: You can start an LLC by yourself in Ohio

Yes. You can complete the Articles of Organization on your own, but seeking a lawyer’s advice is advisable.

Q: You can complete the LLC formation in Ohio in 5–10 days?

Online filings are normally completed in 3–5 days during business weeks. Mail filings may take 1–2 weeks.

Q: Is it possible to alter my LLC’s name after it's established?

Yes. You must submit an updated Articles of Organization to the Secretary of State and pay a fee.

Q: Is an operating license required to conduct business in Ohio?

Requirements vary according to your business type and where you operate. Most cities and towns have different rules about what licenses you’ll need to work there.

Q: Do licensing requirements vary by business type and location?

While not legally required in Ohio, a written Operating Agreement is highly recommended to clearly outline how your LLC operates and how disputes are handled.

10. Conclusion:

Starting an LLC in Ohio offers numerous potential benefits, but it’s important to keep your business in line with state regulations.

Every stage of the process plays a role in ensuring your LLC is legally compliant and actively up and running.

Get started on the path to prosperity, knowing your Ohio LLC is ready to expand and is shielded from liabilities.