Thinking about having your side hustle be your main business?

Or maybe you want to avoid working for others and start making something you can call your own?

Starting a business in North Carolina is easy if you decide to form an LLC.

Due to its favourable taxes, talent pool and booming economy, North Carolina is climbing the ranks for entrepreneurs. If you decide to start an online company, a shop in your area or freelance for clients, the advantages of an LLC can help you take risks confidently.

The guide will outline the process of registering an LLC in North Carolina, from the first decision to every important step.

Table of contents

- Why Start an LLC in North Carolina?

- Step-by-Step: How to Start an LLC in North Carolina

- LLC Formation Costs in North Carolina

- Maintaining Your North Carolina LLC

- Manage Finances with Wise Business

- Frequently Asked Questions

- Final Thoughts

Why Start an LLC in North Carolina?

The choice to establish an LLC in North Carolina makes sense for business owners, given the low starting costs, easy way to establish the business, and business-friendly climate. First, North Carolina gives both small and medium-sized businesses some of the lowest corporate income tax rates out there. Additionally, the state does not require most LLCS to pay franchise tax. The skilled labour, economic development, and solid infrastructure in North Carolina help businesses in many industries to succeed. Creating an LLC offers ways to safeguard your assets and provides flexible ways to run the business. You can quickly and easily register your LLC online through the North Carolina Secretary of State.

Step-by-Step: How to Start an LLC in North Carolina

Forming an LLC in North Carolina is relatively straightforward if you follow the steps below:

1. Choose Your LLC Name

Any LLC name you pick needs to be different from all other businesses in the state. You should add “Limited Liability Company” or the abbreviations “LLC” or “L.L.C” to your name. Check on the North Carolina Secretary of State’s website to make sure your name hasn’t already been taken.

Another good thing to do is pick a name that clearly states your business’s purpose and is simple to recall. Try to avoid names that sound much like those of other companies, since this might confuse your customers. A short reservation of your name is possible for three months, at a small price, if you want to start the process later.

Helpful Hint: Business name generators can help develop unique name ideas available in North Carolina.

Name Rules That Matter

- Incorporate Limited Liability Company or L.L.C. or Limited Liability Company.

- Words such as government agency should be avoided.

- Choose an easy-to-remember and simple name that is aligned with your mission.

- Book the name if you require time.

- Prepare a domain and social handles to match and enable customers to find them easily.

2. Create a Business Plan

Keep it short and useful. Provide your proposal, market, price, and initial year objectives. Include a brief market analysis, your mode of operation and measurement of success. It is sufficient to begin with a one-page model with customers, channels, costs and revenue.

3. Appoint a Registered Agent

A registered agent is responsible for getting the legal documents that are sent to your LLC. Both individuals and businesses serving as agents are allowed to do business in North Carolina.

Any insurance agent you pick must be based in North Carolina and able to be contacted during standard business hours. Some people choose to be their registered agent, but many decide to hire a professional company for better protection and adherence to the law. The importance of this job comes from the fact that not locating required documents could have legal consequences.

Registered Agent Requirements

The agent should be 18 years of age with a North Carolina mailing address and access to legal papers during regular business hours. You can either be an agent yourself or employ a service.

4. File Articles of Organization

You use this form to officially establish your LLC with the North Carolina Secretary of State. You can send your application either via the internet or by postal service.

Do not forget to write your LLC’s name, the details of your registered agent, and how your LLC will be managed. The primary cost to consider when calculating the LLC cost NC is the state filing fee. Online filing in the state of North Carolina is currently at $95, whereas the cost of LLC in North Carolina by mail is at $100. Once accepted, your LLC will be officially accepted by the state as a business entity.

The question is, how much is an LLC in NC? Entrepreneurs should consider the cost of at least 95-100 dollars to get filed. You may include professional services or extras, which will make up the overall amount of your set-up costs. Do not forget to retain a copy of your Articles of Organization.

5. Get Your Certificate of Registration

Once your filing is accepted, you are given a certificate of registration by the state, which proves that your LLC exists. Pay and file the fee, and store the certificate in the core records.

6. Create an Operating Agreement

An operating agreement tells you how your LLC is managed. It includes the rules for who owns the business, who they are responsible for it, and how profits and losses will be distributed. It may avoid fights between members and preserve your limited liability rights. Having an operating agreement is necessary for single-member LLCs as well.

7. Get an EIN (Employer Identification Number)

You can think of an EIN as a Social Security number for your business. A business needs it to set up a company’s bank account, hire workers, and pay federal taxes.

You are able to apply online for free via the IRS website. If you’re a one-person business LLC, you may not need an EIN, but getting one still helps you keep your business and personal funds separated. It builds more trust with the banks and vendors you deal with.

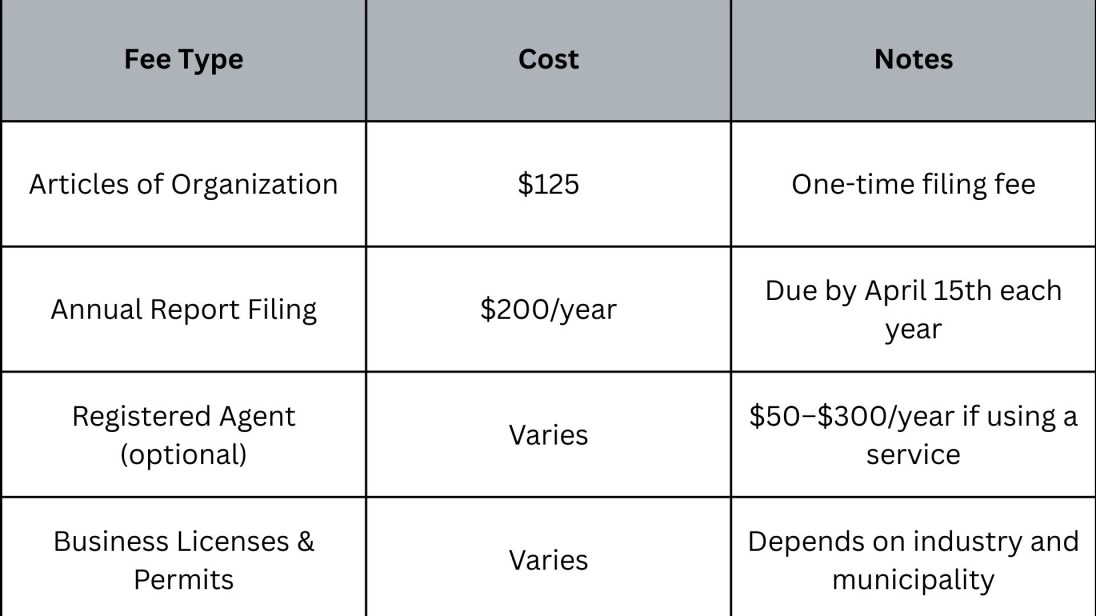

LLC Formation Costs in North Carolina

Maintaining Your North Carolina LLC

In North Carolina, LLCs are required to submit an annual report to the Secretary of State before April 15 of every year. The charge is 202 ($3 additional in the event of online filing). Online filing is quicker and more trustworthy than the post.

You have to renew all your business licenses, update your documents as needed, and change the registered agent if necessary. Following the regulations allows your LLC to enjoy its legal benefits.

1. File Annual Reports

To maintain their business status in North Carolina, LLCS have to submit an annual report to the Secretary of State each year. The report helps the state know the current location of your company, who is acting as your registered agent, and the details of your management.

Due date: April 15 every year

Fee: $202 (plus $3 if filed online)

File here: NC Annual Report Filing

Although you have the option of filing by mail, it is faster to use the online method. If you do not meet the legal deadline, this may cause your LLC to be terminated by the authorities.

2. Keep Licenses and Permits Current

North Carolina does not grant any statewide general business license. A large number of occupations are licensed by occupational boards and local governments. Before renewals are due, check your rules and county to see if it is late.

3. Stay Current with Licenses and Permits

Local cities and counties might have their own set of business licenses and permit rules, in addition to the state’s. You should contact your local city or county government to see what rules are relevant for your business location.

The price you pay depends on the industry and the city where your business is located. One-time permit costs $25 for businesses in Marion, and the annual license fee is also $25. Keeping all your business licenses up-to-date prevents penalties and pauses in what you do.

4. Pay Taxes

- Pass-through by default: A majority of LLCs default on profits and losses to owners who report on personal returns.

- Corporate option: You are free to choose corporate taxation if it fits your figures.

- Personal income tax: North Carolina has a flat rate of income tax.

- Employment taxes: If you are an employer, register, withhold, and pay on time.

- Local taxes: Counties may impose local taxes in addition to those of the entire state. Price and cash flow planning: Check your county when setting prices.

Manage Your LLC Finances

Create a bank account, open a payment processor, and start tracking income and expenses on day one. Clean books assist in tax, capital and prudent decision making.

Business Insurance You Should Consider

- General accident and injury, and other claims liability.

- Professional liability in case of service or advice.

- Fire, weather, or theft of commercial property.

- Cyber liability is when you do online selling or store customer information.

Advantages of a North Carolina LLC

Affordable Filing Fee

Establishing an LLC is cost-effective to start. The Articles of Organisation are cheap at only $125, as compared to many states.

Pass-Through Taxation

A North Carolina LLC does not pay corporate double taxation by default. Profits and losses are directly transferred to the members' personal tax returns.

Business-Friendly Environment

The state of North Carolina has a great economy with consistent growth in its various industries such as technology, health, agriculture and manufacturing. It is called a pro-business state.

Flexible Management

Member-managed or manager-managed structures are both available, so owners are free to operate the LLC in the style that best fits them.

Strong Workforce & Location

The state offers a good environment to small and mid-sized businesses with the availability of the best universities and a skilled labour force, in addition to the accessibility of Southeastern markets.

Disadvantages of a North Carolina LLC

Annual Report Fee

All LLCs have to submit an annual report to the Secretary of State and pay $200 (a little more than in other states).

Flat State Income Tax

Although easier, the North Carolina 4.5 per cent flat income tax (2025 rate) is charged on the profits of LLC owners, which increases total expenses.

Limited National Prestige

Forming in North Carolina does not bring recognition to investors or other larger corporations as compared to Delaware or New York.

Extra Costs for Out-of-State Owners

You will also be required to register a foreign LLC in your home state if you do not live or operate in North Carolina. This doubles compliance work and fees.

Frequently Asked Questions

How long does it take to start an LLC in North Carolina?

This means that when you submit online, it can be approved in 3-5 business days. By mail, it can take up to 2 weeks. Expedited processing is available at an extra charge.

Do I need a registered agent for my North Carolina LLC?

Yes. All LLCs in North Carolina are required to have a registered agent with a physical address in the state. You may be your own or pay for a professional service.

How do you get an LLC in North Carolina?

The procedure to get an LLC in North Carolina includes filing the Articles of Organization with the Secretary of State, paying the $95-100 fee and producing an operating agreement.

How do you get a free LLC in North Carolina?

You cannot avoid having to pay mandatory state filing fees, but you can also reduce the expenses by preparing and submitting the documents personally instead of paying third-party services.

How do you open an LLC in North Carolina?

In North Carolina, the first step in forming an LLC is to find a distinctive name for the business, find a registered agent, and submit the Articles of Organization. Once it is approved, prepare your operating agreement and request an EIN.

How do you set up an LLC in North Carolina?

you need to choose the name, submit the Articles of Organization, pay the state fee, publish the necessary notices, and maintain your operating agreement in the records.

How much does it cost to start an LLC in North Carolina?

The online filing fee is $95, and the mailing filing fee is $100. It may be subject to additional charges in the form of local licenses or professional services. Therefore, in response to the question as to how much is an LLC in NC, the minimum price is less than $100.

Does a shop Carolina LLC have to report revenue or earnings differently?

No. A shop Carolina LLC, is subject to the same tax regulations as other LLCs. Your personal tax return will list the revenue or earnings, except in the case of corporate taxation.

What happens if I miss filing my annual report on time?

If you do not submit your annual report by April 15, you may face late fees, penalties, and your LLC could get officially dissolved by the state, leaving you without your business’s benefits and protections.

Final Thoughts

It makes good sense to set up an LLC in North Carolina due to its low fees, welcoming business climate, and support system.

When you follow the above advice and stay on top of reports, licenses, and taxes, you will see your business succeed in the long run.

If you want your business to go international, look into Wise Business to make dealing with finances outside your country much simpler.