Starting an LLC in Illinois helps you build a strong foundation for your business.

It assists with safeguarding your personal things, your home and savings, if your business encounters problems. That means you are able to concentrate on developing your idea and not analysing risks all the time.

That guide is not just a paperwork series. It is here to lead you through every step clearly, with points that make sense indeed, if you are starting from zero or moving your business in a different direction.

If you want to start an LLC in Illinois, you don’t need to guess; we have included official websites, helpful tools, and advice throughout the way. You see, with the right steps and a little bit of help, you are on your way to establishing a legit, protected, and successful business.

Table of Contents

- A New Take on Business Structures: Why Form an LLC?

- Step-by-Step Instructions for Starting Your LLC in Illinois

- Counting the Costs: A Breakdown of Expenses

- Keys to Long-Term Business Success

- Final Words and What to Do Next

A New Take on Business Structures: Why Form an LLC?

Business owners face the challenge of using innovative ideas without neglecting legal protections when starting up their new venture. Business owners acquire operational flexibility through the protection and simplicity advantages of creating an LLC in Illinois. The difference between an LLC and a sole proprietorship is that an LLC exists separately from its owner. Your personal possessions which include your home and bank account, exist outside of business exposure areas through an LLC structure.

Pass-through taxation provides LLC owners benefits since they avoid double taxation which corporations sometimes require.

Readers who wish to understand the process better should consult the Illinois Secretary of State’s LLC Formation Instructions

Step-by-Step Instructions for Starting Your LLC in Illinois

Choose a Unique Name for Your LLC in Illinois

Unique Name When people first encounter your business they mainly base their initial judgment on its LLC name. Your business name needs to originate from elsewhere while following the rules of Illinois law. To make your LLC name compliant and different from others follow these guidelines.

Make It Distinctive: Use the Illinois Business Entity Search to verify whether your proposed name is available for your LLC. Your business brand-building process becomes simpler when you choose an exclusive name because it stays away from legal complications.

Include Required Terms: Legal operation of your LLC requires concluding your business name with “Limited Liability Company” or “LLC” or “L.L.C.” An official annotation indicates to the public that your company holds an LLC legal structure.

Stay Clear of Restricted Words: Avoid using vocabulary which implies you are affiliated with public agencies through terms like “FBI” or “Treasury”. Refer to the Illinois Naming Guidelines for an entire list of restricted terms.

Check Domain Availability: Confirm your chosen business name is available for online domain ownership as well. The state of Illinois provides several tools for business owners to assist them.

- Business Entity Search Tool: The Business Entity Search Tool functions as an application that verifies if any party has claimed the brand name.

- Corporate Name Availability Inquiry Form: The Corporate Name Availability Inquiry Form serves as a detailed checking mechanism, despite not providing final confirmation about name availability.

Helpful Hint: Business name generators assist firms in creating suitable name options for organizations that face difficulties generating distinctive names.

The Essential Role of a Registered Agent

Our business needs a registered agent who receives important papers and legal notices for registering an LLC. Appointing a registered agent is essential for obtaining your LLC status in Illinois.

Key Qualities of a Registered Agent:

- Located in Illinois: To act as your registered agent your selection must live and work in Illinois at a permanent address. P.O. Boxes won’t work.

- Available During Business Hours: Your registered agent needs to be reachable all business days from Monday to Friday.

- Trustworthy Service: Companies commonly engage professional registered agent services to perform this task. You will find detailed information about this topic at the Illinois Secretary of State’s Registered Agent Information website.

You can handle this role on your own or assign your registered agent service tasks to an expert company.

The Road to Legal Formation: Articles of Organization

Officially creating an LLC is conducted by submitting Articles of Organization to the Secretary of State's office. Your business becomes recognized under the law when you work on Florida LLC formation.

How It’s Done:

- Gather Basic Info: Start by supplying the required information, which includes your LLC name, physical address, registered agent contact details and business nature.

- Fill Out Form LLC‑5.5: You can find and submit LLC-5.5 on our online and postal platforms. To start your process review Illinois Secretary of State’s Business Services page.

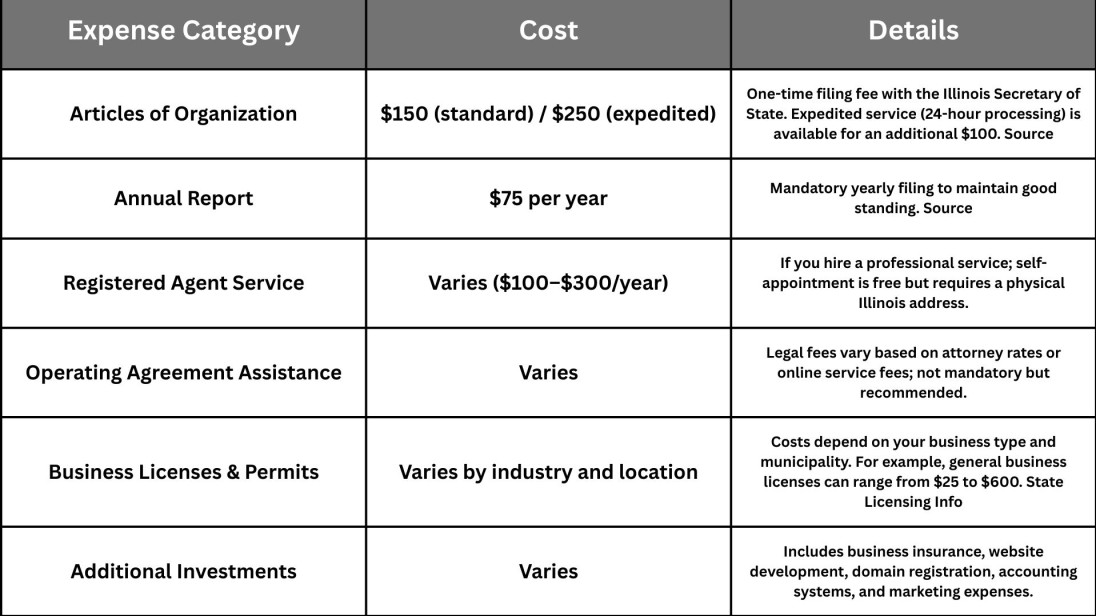

- Pay the $150 Fee: Paying $150 ends your company formation process through the team.

Your LLC becomes an active business the moment the Secretary of State accepts your application. Keep one copy of this document in your business records.

Creating a Blueprint as Your Operating Agreement

Even though Illinois does not require it, businesses make operating agreements because they benefit the operation. An operating agreement explains what operations your LLC will perform as a business structure.

Why It’s Useful:

- Clarifies Responsibilities: Describes Responsibilities and Control Rules through Decisions about Money Distribution.

- Adds Legal Security: A legal agreement shields your personal funds by keeping them apart from your business activities.

- Prevents Future Disputes: The agreement creates standard methods to deal with arguments that arise between members.

The LegalZoom website or a lawyer can create your operating agreement for you.

Getting an EIN for Securing Your Business Identity

Business IdentityAn LLC must get its federal tax ID, known as an EIN, to conduct business legally. Every business must obtain an EIN to fulfil tax obligations and meet banking and employee hiring requirements.

How to Apply:

- It’s Free and Fast: You can quickly obtain a free EIN at the IRS EIN Online Application webpage. You should never pay for an EIN service since obtaining this number is completely free.

- Use It for Everything: Your EIN facilitates all important business processes that involve taxes and financial transactions.

Compliance and Licenses: Permits to Prosperity

Running a legal LLC in Illinois requires acquiring necessary permits from both state and local authorities. Building these permits boosts customer trust.

Here’s How to Get Them:

- Know State Requirements: Use the Illinois Department of Financial & Professional Regulation to determine which licenses your field demands.

- Review Local Guidelines: Check with your municipality's office because they will explain which permits your company needs to run there.

- Submit Your Applications: Forward All Necessary Documents Along with Payment of Fees.

Maintaining Your Business Legacy: Annual Reporting

Your Illinois LLC stays up to date when you submit an annual report to the Illinois Secretary of State. The report lets you submit your current business data to official records.

What You Need to Know:

- Details Required: Include up-to-date contact and company information.

- Filing Fee: $75 each year.

- Deadline: The date to complete your annual report falls on year number 1 and every year following that of your LLC formation. A late submission will lead to legal fines and the closure of your business operations.

Counting the Costs: A Breakdown of Expenses

Keys to Long-Term Business Success

Your LLC formation does not signal the end of the business journey. You need to maintain your focus on future growth and design strategies wisely to establish a flourishing business.

Follow these practices to stay on track:

Clearly Separate Your Finances: Create a separate bank account for business expenses and money to differ clearly from your personal funds. Running a separate business account keeps your personal and startup records separate while preventing taxation and legal problems.

Secure the Right Insurance Coverage: To avoid business risks, select the right insurance plans that guard your operation. Use Illinois Department of Insurance services to check small business insurance plans that suit your unique sector.

Maintain Thorough Documentation: Note down everything about your financial deals, choices and office records. Recorded details simplify tax preparation and serve as evidence during tax review sessions.

Stay Ahead on Compliance: Check all government requirements to keep your company in legal compliance above deadlines for annual reports, licensing and taxes. Check the official site of the Illinois Secretary of State’s office consistently to access current business regulations.

Strengthen Your Digital Image: Set up an expert website and use social networks to reach your audience. Zoviz lets businesses create online platforms that deliver their brand personality better.

Make Strategic Connections: Be part of local business associations through real-life and virtual networks. Connected to others through networking helps you discover useful business guidance and relationship opportunities for growth.

Work with Trusted Advisors: Business developers should consult with legal and financial experts who will improve their systems and guide their efforts based on the latest regulations.

Final Words and What to Do Next

Starting an LLC in Illinois protects your assets and presents new opportunities for your business. Your business will develop long-term growth potential through effective preparation.

Every part of forming an LLC helps you build a business perceived as legitimate and trustworthy.

Continue your education and consult proven sources including the Illinois Secretary of State and IRS to succeed.

The time has arrived to bring your business idea to life while building something enduring.