Are you seeking to establish your own business within California?

Your decision to start LLC in California makes you brave because this guide offers step-by-step directions.

The Limited Liability Company (LLC) serves as an ideal business structure for freelancers as well as entrepreneurs and small business owners in California. This particular business structure simultaneously provides organizational credibility and asset protection and enables flexible management and taxation controls.

Every step in starting your business requires both legal procedures and administrative obligations that begin with business naming and finish with officially submitting paperwork while maintaining state regulations.

The 2025 guide simplifies the process by providing official resources that break down registration costs and state tax rules for confident LLC formation.

Table of Contents

- Understanding LLCs in California: Why It’s a Smart Move

- Step-by-Step Guide to Forming Your California LLC

- Pricing Information for Creating an LLC in California

- Ongoing Requirements for Your LLC

- Who Can Launch an LLC in California?

- Why Starting an LLC in California Could Be a Game Changer

- Is an LLC in California Right for You? Potential Drawbacks

- What to Do After You’ve Set Up Your LLC

- FAQs

- Conclusion

1. Understanding LLCs in California: Why It’s a Smart Move

To combine the corporate liability restriction with the tax flexibility and organisational ease of partnerships and sole proprietorships, companies should select an LLC (Limited Liability Company). Small companies in California commonly select the LLC business structure.

Why Choose an LLC in California?

- Liability Protection: Protection from personal financial loss extends to your property including your home and savings, when your business must face financial lawsuits or debts.

- Tax Flexibility: The profits and losses of an LLC flow through to personal taxation because it functions as a “pass-through” entity, which prevents double taxation.

- Operational Simplicity: The operational structure of LLCs remains simpler than that of corporations because they need fewer administrative requirements.

- Credibility: The act of registering an LLC creates a professional appearance that builds trust among customers, along with industry partners.

For official information, visit the California Secretary of State’s website.

2. Step-by-Step Guide to Forming Your California LLC

2.1 Choose a Unique Name for Your LLC

The naming process for your LLC extends beyond marketing considerations because California has specific legal requirements to fulfil. A business name must stand apart from previously registered entities as recorded with the California Secretary of State, and it needs to list “LLC,” “L.L.C.”, or “Limited Liability Company” as its legal designation. Using names which appear to connect your business to a government agency or restricted profession must be followed by appropriate licensing before being approved.

The following procedure guarantees your name compliance with regulatory standards:

- Verify Name Availability: Use the California Business Search Tool to check whether your preferred name is free for use in business registration to confirm that your desired name isn’t already in use.

- Avoid Restricted Terms: Your business name should exclude terms which imply a governmental relationship or demand official authorization, since these include words like “Agency,” “Municipal,” or “Commission”.

- Reserve Your Name (Optional): You can hold your company name temporarily through a Name Reservation Request for a maximum of 60 days if you want to reserve it before registration.

- Check Domain Availability: Test domain availability early as it helps you lock in an identical domain name to keep your online platforms uniform.

- Use Name Generator Tools: The use of business name generators creates new possibilities. This tool generates names matching your niche concepts along with core values as you search for a solution.

The selection of an appropriate business name that fulfils both regulatory and brand-focused criteria helps establish trustworthiness at the business’s beginning.

Helpful Hint: A business name generator is a useful tool for generating inspirational names when it is difficult to come up with a unique, suitable name.

2.2 Appoint a Registered Agent

All California LLCs need to designate a Registered Agent who performs the duty of receiving vital legal documents, official state messages and acts on behalf of the company. A Registered Agent needs to operate with a physical California address which remains accessible during all normal business hours.

Your options for a Registered Agent in California depend on these essential factors:

- Dependability: A dependable person should become your registered agent because they can handle sensitive legal documents quickly by forwarding them to you without any delays.

- Availability: A designated agent needs to remain at the listed business address throughout normal operating times so they can take delivery of postal documents in person.

- Compliance: Either one who resides in California or an authorized business organisation can serve as your agent. Your LLC structure cannot fill a Registered Agent position.

- Privacy: Employing your own agent might lead to your residence becoming accessible to the public domain. Your privacy remains protected, and your agent stays consistently available for the delivery of paperwork through the use of third-party services.

A corporate Registered Agent needs to hold registration with the California Secretary of State together with a filed Corporate Registered Agent Application.

For further details, refer to the California Secretary of State’s Registered Agent guidelines.

2.3 File Articles of Organization

The official establishment of your California LLC demands a filing of its Articles of Organization. The process of LLC-1 submission to the Secretary of State requires payment of a $70 filing fee either through online or postal channels.

Here’s how the process works:

- Submit Your Business Details: When you file Form LLC-1, you must present your LLC’s official name, together with its business address, along with specific information about your chosen registered agent and management structure, either as member-managed or manager-managed.

- File Form LLC-1: Use Form LLC-1 to submit your filing content precisely before processing it through the California Secretary of State's online portal or through the postal service.

- Pay the Filing Fee: The California filing fee payment for LLC formation stands at $70 at present. After your submission and the approval by the authorities, your new LLC will get official recognition as a legal California entity.

Your LLC’s legal foundation exists within this document therefore verifying that each entry is both precise and maintains harmonious consistency between all official documents.

2.4 Create an Operating Agreement

Although California does not require you to file an Operating Agreement with the state, having one is essential for both single-member and multi-member LLCs. It outlines the ownership, management, and operational rules of your business. This internal document helps prevent future conflicts and provides legal structure to your LLC.

Your Operating Agreement should cover:

- Ownership Percentages: Clearly define how much of the LLC each member owns.

- Profit and Loss Distribution: Specify how earnings will be shared among members.

- Management Structure: Describe whether the LLC is managed by members or appointed managers.

- Voting Rights & Responsibilities: Include rules for voting on key decisions.

- Procedures for Adding or Removing Members: Ensure clarity on handling ownership changes.

Having a detailed Operating Agreement not only clarifies internal roles but also strengthens your LLC’s credibility in the eyes of banks, investors, and courts.

2.5 Get an EIN from the IRS

Your LLC needs an Employer Identification Number (EIN), which functions similarly to an SSN for business entities. An EIN becomes necessary when your LLC exceeds one member, in addition to the employment of staff and the opening of a business account opening. Single-member LLCs also receive benefits from obtaining an EIN despite their basic structure.

How to get an EIN:

- Apply Online via the IRS Website: The IRS website offers a free application that requires only a few moments to complete.

- No SSN? Apply by Mail or Fax: Non-U.S. residents and people without a Social Security Number can obtain an EIN through Form SS-4 using mail or fax application methods.

- Use the EIN for Business Transactions: This number helps the business handle various transaction matters, including the hiring process for employees, tax and license applications, and loan applications.

Obtaining your EIN at the beginning enables your business to be more adaptive and ready for future expansion even if you do not require any employees currently.

Apply for free at the IRS website.

2.6 File the Initial Statement of Information

The law in California demands that new LLCs submit their Initial Statement of Information to state authorities no later than 90 days after Articles of Organization certification. The state needs up-to-date LLC information through this filing, which includes the business address, together with management and member or manager names and organization details.

To complete this step:

- The filing authority that accepts LLC-12 exists both through postal delivery and online submission channels.

- Submit the following Business Details to the Secretary of State: Name of LLC along with file number, business address and mailing address linked with agent information and member and manager specifics.

- Pay the $20 Filing Fee: Must pay a single $20 initial filing charge. A new filing of this document becomes necessary for your LLC every two years as part of your mandatory biennial report process.

Timely filing of your Statement of Information prevents payment of late fees and supports your LLC's status as an acceptable business entity within the state. California Statement of Information

2.7 Register for State Taxes and Obtain Licenses

To operate lawfully within California, you must register for particular state taxes, together with relevant licenses or permits that fit your business activities. To sell or lease tangible goods that require sales tax, your LLC requires a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA). Both retailers, along Seller’s Permit doing business inside California state must follow this requirement.

When an LLC hires employees they need to enroll with the Employment Development Department (EDD) through paying their employees more than $100 during a quarterly period. Through the EDD’s e-Services for Business portal business owners can handle payroll taxes while making payments and filing submissions through an online system.

Tax registrations are necessary, but your business can also require particular local licenses or permits based on your industry scope, together with geographical location. Browse CalGold website to determine which permits and licenses your specific business needs and the relevant jurisdiction needs. The tool enables users to locate local departments that handle the necessary document approvals in their area.

Tip: Your LLC will benefit from early preparation of these requirements because it reduces delays and ensures complete legal compliance from its first operation.

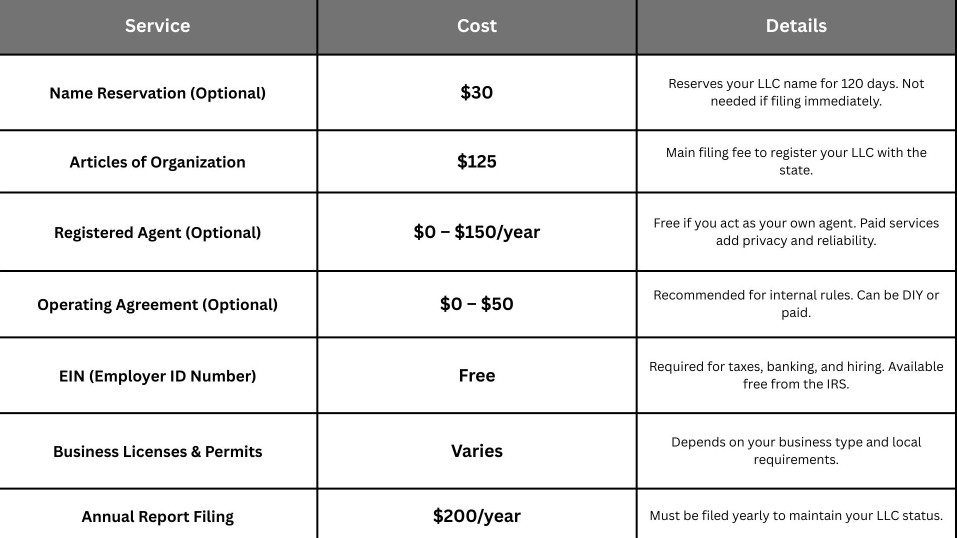

3. Pricing Information for Creating an LLC in California

4. Ongoing Requirements for Your LLC

4.1 Annual Franchise Tax

Every California LLC needs to pay an annual franchise tax regardless of its profit or loss status. Every LLC in California must pay at least $800 each year. The tax payment maintains your LLC in active status and ensures good standing status with the state.

4.2 Biennial Statement of Information

The Statement of Information (Form LLC-12) represents a necessary biennial filing requirement for your LLC. The Statement of Information requires the state system to receive updates about your LLC's address together with member and manager information. The required $20 filing expense must be paid by LLC owners or else their business operations may suffer penalties leading to possible suspension.

5. Who Can Launch an LLC in California?

Non-US residents along with individuals who are 18 years old or older can establish an LLC in California. Every California business requires a registered agent who holds a physical California address although the owner does not need to reside within the state. An LLC's registered agent takes care of handling all vital documents. Forming an LLC requires someone to comply with state regulations even though they do not need to be a U.S. citizen. However, this person is responsible for providing proper information when setting up the business entity.

6. Why Starting an LLC in California Could Be a Game Changer

Start an LLC in California because it provides many advantages that draw numerous entrepreneurs to this option. Several important elements demonstrate why business formation as an LLC in California would be a wise decision:

1. Access to a Large Market

The economy of California stands as the largest in the United States and provides businesses with substantial market diversity. The combination of technology alongside entertainment and agriculture alongside tourism sectors provides California with a wide range of customers to serve. Through its dynamic economic landscape entrepreneurs can easily discover ample growth opportunities available in this state. Detailed business information about California is available on the California Business Portal website., visit the California Business Portal.

2. Liability Protection

Business liabilities and legal responsibilities do not harm personal assets when you operate under an LLC structure because this protects your personal assets during lawsuits or business debts. The business liability protection system prevents personal finances from mixing with business financial liabilities. Read more about LLC owner liability protection at the U.S. Small Business Administration (SBA) website., visit the U.S. Small Business Administration (SBA).

3. Credibility

California business entities gain superior professional credibility by operating as LLCs. The validation demonstrates to clients as well as investors and suppliers that your company operates legitimately in fields where trust stays essential. The California Secretary of State of State provides expanded information about establishing trustworthiness when doing business in the state.

7. Is an LLC in California Right for You? Potential Drawbacks

California LLCs present numerous advantages, yet individuals need to consider specific negative aspects when making their selection:

1. High Fees and Taxes

Business taxes throughout California remain among the higher levied amounts in the United States. A fundamental requirement for every LLC business operating in California is payment of the required minimum franchise tax of $800 each year. The tax framework implemented by the state becomes a weighty burden for emerging business enterprises. The California Franchise Tax Board website offers information about business taxes imposed in the state of California.

2. Complex Regulations

Every business operating in California must fulfill multiple regulations which extend from environmental standards to employee protection requirements. Lawful assistance becomes necessary to ensure compliance with regulations. Detailed information about such guidelines exists on the California Department of Industrial Relations.

3. Ongoing Compliance

All California LLCs need to file Statements of Information twice during a two-year period. The failure to fulfil required obligations will result in business suspension among possible penalties. All needed compliance information comes from the California Secretary of State.

8. What to Do After You’ve Set Up Your LLC in California

There are multiple vital steps your LLC needs to follow to maintain operation and compliance after the establishment process:

1. Obtain an Employer Identification Number (EIN)

Having an Employer Identification Number will serve as a requirement for tax management along with business bank account setup. The IRS provides free applications through which you can obtain an EIN.

2. Register for State Taxes

Business operators of different types must register for state taxes that cover sales tax together with employment tax requirements. A business can start operations by reaching out to the, contact the California Department of Tax and Fee Administration (CDTFA).

3. Obtain Necessary Permits and Licenses

Certain business activities need particular authorizations and official licenses for operation. The California Business Portal assists businesses by identifying essential permits and licenses for their business sector and geographic area.

4. Maintain Your LLC’s Good Standing

Your LLC relies on filing biennial statements while staying updated with all taxes to maintain its good standing. The California Secretary of State website contains complete information about maintaining good standing status.

9. Frequently Asked Questions (FAQs)

1. Do I need a lawyer to open an LLC in California?

Although a lawyer is not required to establish an LLC in California you should seek legal counsel when you face particular legal problems. Read about procedures at the California Secretary of State to get more information.

2. How much does it cost to start an LLC in California?

The costs of starting an LLC in California include:

- Articles of Organization Filing Fee: $70

- Initial Statement of Information Filing Fee: $20

- Annual Franchise Tax: $800 minimum, due annually.

Other startup expenses comprise both a registered agent service as well as business license fees and professional fees.

3. How long does it take to form an LLC in California?

Processing times vary:

- Online Filings: Typically within 3-5 business days

- Mail Filings: Several weeks

Faster filing of applications is possible through direct submission to theCalifornia Secretary of State’s.

4. Are there ongoing requirements for an LLC in California?

Yes, your LLC must:

- Pay the annual franchise tax ($800)

- An LLC in California needs to submit a biennial Statement of Information through Form LLC-12.

The California Franchise Tax Board together with the California Secretary of State. website provides complete guidance for your needs.

5. What is an Operating Agreement, and is it required in California?

An Operating Agreement describes how your LLC functions when it comes to ownership responsibilities and managerial responsibilities. Law does not require Operating Agreements, yet one is strongly advised to avert conflicts between members. The California Secretary of State provides complete details about this information.

6. Do I have to file taxes for an LLC if it has no income?

The filing of Form 568, together with the annual $800 franchise tax, becomes mandatory for every LLC regardless of its income levels. Users can obtain additional information about California Franchise Tax Board policies at their website.

7. Can I form a single-member LLC in California?

A single-member LLC remains legal in California, thus offering individual owners complete liability protection.

8. Is forming an LLC in California worth it?

The higher costs, together with the regulatory requirements of LLC formation in California, bring valuable protection against lawsuits and flexibility in taxation benefits. Review the advantages and their corresponding difficulties before making a decision.

9. Do I need a lawyer to start an LLC in California?

Having professional legal help can be beneficial, but it remains optional because an LLC formation does not require legal representation.

10. What are the ongoing requirements for maintaining an LLC in California?

An LLC maintains its good standing in California through regular biennial statement filings combined with yearly franchise tax payments.

Conclusion:

Californian LLC formation enables business owners to receive both liability protection advantages and boosted credibility. Businesses must follow every California state requirement along with regulations to maintain their compliance status. Additional information about establishing an LLC exists on the official California Secretary of State website and the Franchise Tax Board platform which enables seamless and successful forming of new LLCs.