Got a business idea burning in your mind? Let’s make it real.

Starting an LLC in Michigan is a good way to protect yourself while running a serious business. It provides your business with the legal identity and can contribute to receiving more trust and respect from customers, banks and partners.

creating an LLC in Michigan is not just easy, it is cheap. Whether you are starting an all-new business or turning your current business into an LLC, you’ll have legal protection and increased control of how your business functions.

Therefore, you want to start your LLC in Michigan, you can do so below. This ultimate guide will walk you through all steps.

Table of Contents

- Why Start an LLC?

- Steps to Form Your LLC in Michigan

- Tips for Running a Successful LLC

- Final Thoughts

Why Start an LLC?

Entrepreneurship is thrilling, but dangerous. Perhaps the best means of reducing those risks is to form an LLC (Limited Liability Company). Now we can see why so many people in Michigan will opt for this type of business structure:

Keeps Your Personal Assets Safe

In the event that your enterprise has got into debt or court difficulties, your own resources, home, or car cannot be seized. The LLC is regarded as its own entity, the business is separate from you, so only the business is accountable. This helps you sleep better knowing your personal life is still secure. Even if your business faces losses, your personal assets remain protected.

Simple Setup and Management

LLC's are less difficult to operate than most corporations. You don’t need to gather for a yearly meeting or follow complex rules. You can concentrate on operating your own business your own way. While paperwork is minimal, you’ll still need to file an annual statement with the state. It is perfect for small business owners who wish less stress and more control.

Affordable to Start

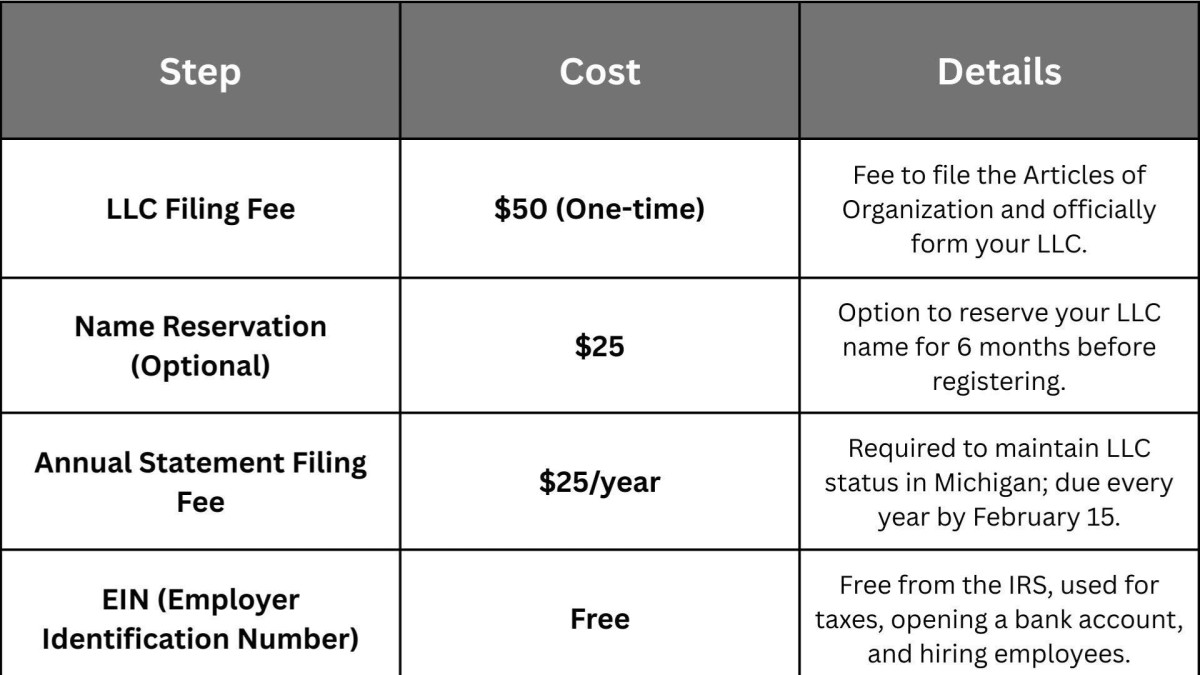

You don’t have to spend much to form an LLC in Michigan. The filing fee is just $50. Many hire it up themselves, not hiring a lawyer at all.

It’s one of the most unpriced ways of opening a business legally. You can use that money to grow your brand instead of spending it on high startup legal fees.

Makes You Look Professional

When your business name ends with “LLC” customers see you’re serious. It is good to build trust and show that you are a registered business. An LLC is more likely to partner with banks, vendors and partners. It provides your business with a more polished, more reliable image.

Works for Solo Owners or Teams

You may choose to run the LLC alone or with a partner or small group. It is adaptable to all types of business arrangements.

Whether you’re running a solo business or managing a team, the LLC structure benefits all. You can also update ownership if your team increases at a later stage.

Steps to Form Your LLC in Michigan

Step 1: Pick a Name for Your LLC

The very first thing you must do to create your Michigan LLC is select a distinctive name containing “LLC,” or “Limited Liability Company”. You will need your name to be dissimilar from the name of a registered business in the state. To test whether there is availability, you can use the Michigan Business Entity Search. If you wish to lock your name in before the official filing, you can reserve that spot by turning in the Name Reservation Form and paying $25. A helpful tip: If you are stuck, try to look at an online business name generator for inspiration. Be sure the name fits your brand identity and is believable, it will be on everything branded, from your website or a business card.

Helpful Hint: Business name generators assist businesses in creating suitable name options as they struggle to give their firms different names.

Step 2: Choose a Registered Agent

A registered agent must be appointed by every LLC in Michigan. This person or company receives highly important legal documents and government notifications on behalf of your business. Your registered agent can be either yourself or someone you trust or a professional service, but you must be a Michigan resident and at least 18 years of age. More information is available on the LARA Registered Agent Info page.

Please note, the agent should be available in business hours. If you want to keep your address private, consulting with a professional service may be a wise decision.

Step 3: File Articles of Organization

To get it officially registered as an LLC, you’re going to need to file the Articles of Organization (Form CSCL/CD-700). This is the legal paperwork that sets up your LLC in the state of Michigan. You can either e-file it through the Corporations Filing System or you can download and mail the PDF form. The filing fee is $50. After approval, you will have a valid LLC legally. The state will confirm this to you, so guard that document, because that is proof that your business is actively registered.

Step 4: Write an Operating Agreement

Although it isn’t a necessity for Michigan, it is advisable to create an Operating Agreement. This ‘internal’ document sets out how your business will operate, from ownership shares through where profits are allocated, right up to critical decision-making. It is particularly so if you have business partners and avoid possible future controversies. With this document, even if you have one business owner, it gives you structure and professionalism. There is no need to enter this point in the state, just be sure of it in your company records.

Step 5: Get an EIN from the IRS

An EIN or Employer Identification Number is the business equivalent of a Social Security number. You will need it to open a business bank account, pay taxes and employ the workers. The good news? It’s free to apply online through the IRS website. You will get your EIN immediately after completion. It is a milestone in smoothing your business operations and meeting tax laws.

Step 6: Check for Local Permits or Licenses

Depending on the type of business you have, it may be necessary to acquire special permits, licenses. Some industry sectors, such as food service, childcare, beauty salons and construction, will have local regulations. Make sure you check with your city or county to see what you are required to do for your exact business. At the beginning, you can look over at the general information from the Michigan Business Licenses & Permits page. Failure to do so may result in fines or shutting down completely, so it’s best to get it out of the way.

Step 7: File Your Annual Statement

In order to maintain your business as active and good standing, you need to file an Annual Statement with the State of Michigan. It is $25 and is payable by 15th February every year. Even though your company was started late in the year, you still have to file. Failure to do this may result in administrative dissolution of your LLC. Thankfully, the process of filing a complaint is simple and can be applied online or via mail. Make a yearly reminder, this little step is necessary to keep your business status going. Submit it here File Annual Statement, LARA Website

Cost Breakdown to Start an LLC in Michigan

Tips for Running a Successful LLC

1. Separate Business and Personal Finances

To run LLC you need not only to set it up but also to sustain effort for the organization and legality to hold. The most important rules are to separate your personal and business finances completely. Take a business bank account and never confuse personal and company payments. Not only does this protect your liability status but makes accounting and tax filing much easier.

2. Stay on Top of Annual Filings

Punctual filing of your annual reports is another secret of success. In Michigan, failure to meet this deadline could result in a penalty or even dissolution of your LLC. Below you will find important filing dates written up on your calendar for your convenience, and consider using automation or this business compliance service so that you’re not missing out on anything.

3. Keep Accurate Business Records

Also important is keeping accurate records. Maintain contracts, receipts, tax documents and license as best as possible. Good record-keeping will see you make better decisions and protect you in case of audits or legal litigation.

Final Thoughts

Registering LLC in Michigan will make your business punch and safe. It provides a ‘ring-fence’ legal protection to your personal assets, It provides flexible tax treatment according to your decision on the kind of taxation you want - sole proprietorship, partnership, or corporation, and gives an additional measure of professionalism that builds trust with your customers and partners. The process is also simple and economical, giving many new business owners a reason to choose it.

There are a couple of things to remember as you go along. First, creating an LLC can help protect your assets (for example, your house or car) if issues of money or law ever knock on the door to your business. Also, it keeps relatively simple since running an LLC is not as controlled by the rules as corporations are. You’ll also have flexibility, there are different ways to run and tax your business. Just ensure you are compliant by filing according to the time limit on your annual statement and obtain any licenses or permits required for your business.

Remember, getting your LLC is only the first step. With some thought in practice, some consistent work and a clear image, your Michigan business can be something truly worthy, successful and rewarding..